Zepto’s Repeat Rate Dropped by 15%. Investigate Why.

PM Interview Question: Problem Solving / RCA question - Zepto’s Repeat Rate Dropped by 15%. Step by step guide using my 6 step framework.

You’re in your PM interview at an Indian quick-commerce startup, Zepto.

The interviewer leans forward and asks:

→ “Our repeat rate dropped 15% last month. Find out why.”

This isn’t just any metric drop - it’s repeat rate. The lifeblood of quick-commerce. The metric that determines whether you’re building a sustainable business or just burning cash on one-time users.

Most candidates panic.

They start listing obvious things w/o any structure:

“Maybe delivery got slower?”

“Price increased?”

“Competitors offering discounts?”

But, here’s what separates good answers from great ones:

Understanding that repeat rate isn’t just about product quality - it’s about habit formation.

It’s about whether you’ve become essential to someone’s daily routine or just a convenient one-time solution.

In this walkthrough, I’ll show you exactly how to tackle this question using the 6-step framework to answer Problem Solving (or, Root Cause Analysis) questions.

This is the same structured approach that impresses interviewers at Zepto, Blinkit, Swiggy Instamart, Dunzo, and any other quick commerce.

How to Answer Problem Solving / RCA Questions?

Here’s the framework I recommend for every Problem Solving or RCA question. Master this, and you’ll be able to tackle any variation thrown at you.

Use the below framework:

Problem - Clarify the Problem

Hypotheses - Structure Your Hypotheses

Prioritize - Prioritize What to Investigate

Data - Deep Dive with Data

Validate - Validate Your Hypotheses

Recommend - Recommend Next Steps

Refer this deep-dive to read in detail - how to answer any problem-solving or RCA question in a PM interview.

Now, Let’s think through this question out loud using the framework, just like you should in your interview.

Step 1: Clarify the Problem

Before I jump into analysis, I need to understand exactly what we’re measuring and the context around it.

Questions I’d ask the interviewer:

I) About the Metric:

“When you say ‘repeat rate,’ are we measuring the percentage of users who made at least 2 orders in a given period? Or is it something else like orders per user?”

“What’s the time window we’re looking at? Repeat within 7 days, 30 days, or something else?”

“Is this repeat rate for all users, or just users who made their first order during a specific period (cohort-based)?”

“Are we looking at repeat order rate or repeat user rate?”

II) About the Timeframe:

“Which month are we comparing? For example, November vs October?”

“Did the drop happen suddenly or gradually throughout the month?”

“Is this statistically significant, or could it be within normal variance?”

III) About Scope:

“Is this drop across all cities, or concentrated in specific markets?”

“Are all user segments affected equally - new users vs existing users?”

“Any differences by order value, category mix, or time of day?”

IV) About Context:

“Have there been any product changes - delivery fees, minimum order values, UI changes?”

“Any operational changes - delivery time promises, dark store locations, inventory availability?”

“What’s happening in the competitive landscape - Blinkit, Swiggy Instamart, Dunzo pricing or promotions?”

“Any major marketing campaigns that might have changed user acquisition quality?”

Interviewer’s Response:

“Good questions.

Repeat rate is defined as the percentage of users who place a second order within 30 days of their first order.

We’re comparing November cohort (users who made first order in November) vs October cohort. The drop was gradual throughout November. It’s statistically significant.

The drop appears most pronounced in Tier-2 cities where we recently expanded. We did increase delivery fees from ₹20 to ₹35 in early November, and our average delivery time increased from 10 minutes to 14 minutes due to dark store optimization.

Competitors have been aggressive with discounting.”

Step 2: Structure My Hypotheses

Now I’ll organize my thinking using the Internal vs External framework, with special attention to quick-commerce specific factors.

Internal Factors (Product/Business/Operations)

I) Pricing & Economics:

Delivery fee increase (₹20 to ₹35 - mentioned by interviewer) making second order less attractive

Reduced promotional offers for repeat users

Minimum order value changes

Price increases on frequently purchased items

Removal of loyalty benefits or cashback

II) Delivery Experience:

Delivery time increase (10 to 14 minutes - mentioned)

Dark store optimization reducing coverage or increasing distances

Delivery slot availability issues

Order accuracy problems (wrong items, substitutions)

Packaging quality deterioration

III) Product Availability:

Stockouts of popular items increasing

Category breadth reduction

Dark store inventory management issues

SKU rationalization affecting variety

IV) User Experience:

App performance issues or bugs

Checkout friction increases

Payment failures

Push notification fatigue or reduction

Search and discovery problems

Reorder functionality issues

V) User Acquisition Quality:

Expansion to Tier-2 cities (mentioned) bringing lower-intent users

Marketing campaigns attracting deal-seekers, not habit-builders

First-order discounts too aggressive, attracting one-time users

Referral quality deteriorating

External Factors

I) Competitive Dynamics

Aggressive discounting by Blinkit and Swiggy Instamart

Faster delivery promises from competitors

Better product selection on competing platforms

Exclusive partnerships secured by competitors

II) Market & Seasonality

End of the November festival season leading to a post-Diwali demand slump

Monthly income cycles impacting mid-month purchase behavior

Weather changes influencing order frequency

Tier-2 city behavior patterns differing from metro cities

III) User Behavior

Novelty wearing off in newly launched markets

Users comparing quick-commerce with traditional grocery options

Macroeconomic conditions affecting discretionary spending

Shift from urgent, impulse-driven needs to more planned purchases

IV) Measurement Issues

Changes in cohort definitions

Attribution issues with repeat orders

Data pipeline delays

Bot activity or fraudulent transactions affecting metrics

Step 3: Prioritize What to Investigate

I’ll prioritize based on likelihood, impact given the context, and ease of verification.

Top Priority (Investigate First):

1. Delivery Fee Increase Impact (₹20 → ₹35)

Why: 75% price increase on delivery is massive; mentioned by interviewer

Expected Impact: Very High - doubles the cost barrier for low-value orders

Verification: Easy - compare repeat rates before/after fee change, segment by order value

2. Tier-2 City Expansion Effect

Why: Mentioned as where drop is “most pronounced”; different user behavior

Expected Impact: High - new market dynamics, lower purchasing power, different habits

Verification: Easy - compare Tier-1 vs Tier-2 repeat rates, cohort by city tier

3. Delivery Time Increase (10 → 14 minutes)

Why: 40% slower; core value proposition of quick-commerce is speed

Expected Impact: High - erodes competitive advantage

Verification: Medium - analyze satisfaction scores, competitive delivery times

Secondary Priority:

4. User Acquisition Quality in Tier-2

First-order discount economics attracting wrong users

5. Competitive Discounting

Mentioned aggressive competitor activity

6. Festival Season Ending

November post-Diwali effect on consumption

7. Inventory/Availability Issues

Stockouts driving users to competitors for second order

Step 4: Deep Dive with Data

Now I’ll walk through how I’d segment and analyze the data for each priority hypothesis.

Analysis 1: Delivery Fee Impact

Segmentation approach:

By Order Value:

Users with average order value (AOV) < ₹200

AOV ₹200-₹500

AOV > ₹500

Hypothesis: The ₹35 delivery fee disproportionately affects low-value orders, making them economically unattractive.

What I’d investigate:

Compare repeat rates for each AOV segment before (delivery fee ₹20) and after (₹35)

Calculate the “effective markup” the delivery fee creates:

₹150 order: Was 13% fee, now 23% fee

₹300 order: Was 7% fee, now 12% fee

₹500 order: Was 4% fee, now 7% fee

Expected findings if this is the primary cause:

Sharp decline in repeat rate for users with AOV < ₹200 (35-45% drop)

Moderate decline for AOV ₹200-₹500 (15-20% drop)

Minimal impact for AOV > ₹500 (0-5% drop)

First order AOV unchanged, but users not returning for small top-up orders

Drop in order frequency per user (users batching orders to avoid multiple fees)

Further segmentation:

By purchase category:

Quick top-ups (milk, bread, eggs) - high fee sensitivity

Emergency purchases (medicines, baby products) - lower fee sensitivity

Full basket grocery - moderate fee sensitivity

By time of day:

Late night urgent orders (11 PM - 2 AM) - lower fee sensitivity

Planned orders (morning/evening) - higher fee sensitivity

Questions to answer:

Did users shift to larger basket sizes on their first order?

Are users abandoning cart when they see the ₹35 fee?

What’s the cart abandonment rate at checkout?

Analysis 2: Tier-2 City Expansion Impact

Segmentation approach:

By City Tier:

Metro cities (Mumbai, Delhi, Bangalore, etc.)

Tier-1 cities (Pune, Ahmedabad, Jaipur, etc.)

Tier-2 cities (recent expansion markets)

By Tenure in Market:

Markets operational > 6 months

Markets operational 3-6 months

Markets operational < 3 months (new Tier-2 expansions)

What I’d investigate:

Repeat rates by city tier

First order behaviour differences (AOV, category mix, time of day)

User demographics and purchasing power differences

Delivery density and dark store coverage in each tier

Expected findings if Tier-2 is the issue:

Metro repeat rate: Down 5-8% (less affected)

Tier-1 repeat rate: Down 10-12%

Tier-2 repeat rate: Down 25-35% (driving overall decline)

Why Tier-2 might have lower repeat rates:

Economic factors:

Lower disposable income making delivery fees more painful

Price sensitivity higher (comparing to local kirana stores)

Less “time poverty” - people have time to shop at nearby stores

Behavioral factors:

Novelty-driven first orders (”trying out the new app”)

Acquired through aggressive marketing, not organic need

Lower density of “urgent need” moments

Stronger relationships with local kirana stores

Infrastructure factors:

Fewer dark stores = longer delivery times in practice

Lower inventory breadth due to demand uncertainty

Higher stockout rates in new markets

Validation questions:

What’s the first-order satisfaction score by city tier?

Are Tier-2 users complaining about specific issues (price, selection, delivery)?

What’s the competitive landscape in Tier-2 (is Blinkit/Swiggy even there)?

Analysis 3: Delivery Time Impact

Segmentation approach:

By Actual Delivery Time:

Orders delivered in < 10 minutes

Orders delivered in 10-12 minutes

Orders delivered in 12-15 minutes

Orders delivered in > 15 minutes

By User Expectation:

Users promised 10 minutes (old promise)

Users promised 15 minutes (new promise)

Users who experienced both (early Nov cohort)

What I’d investigate:

Correlation between delivery time and repeat rate

Customer satisfaction (CSAT) scores by delivery time bucket

Complaint rates about “slow delivery”

Competitive delivery times (are we still faster or now slower?)

Expected findings if delivery time is a key driver:

Users who got delivered in > 15 minutes: 30-40% lower repeat rate

Users who experienced degradation (were promised 10, got 14): frustrated, lower repeat

Time-sensitive categories (midnight snacks, baby products) most affected

Satisfaction scores dropping proportionally with delivery time

Dark store optimization analysis:

Did optimization reduce number of dark stores or relocate them?

Has average distance from user to dark store increased?

Are we now competing with local stores on speed rather than beating them decisively?

Critical question to answer: At what delivery time does quick-commerce stop being “quick” and become just “online grocery”?

10 minutes = magical, habit-forming

12-15 minutes = still good, but not magical

15-20 minutes = why not just use Swiggy/Dunzo?

20+ minutes = why not plan ahead and use BigBasket/Grofers?

Analysis 4: User Acquisition Quality

Segmentation approach:

By Acquisition Channel:

Organic (direct app open, word of mouth)

Paid (Google/Facebook ads)

Referral (from existing users)

Offline (billboards, flyers in Tier-2 cities)

By First Order Behavior:

Discount used (%) on first order

AOV on first order

Category purchased (daily essentials vs impulse)

Time of day (planned vs urgent)

Days since app install to first order

What I’d investigate:

Repeat rate by acquisition channel

Cost of acquisition vs. lifetime value by channel

First-order discount dependency by cohort

Expected findings if acquisition quality declined:

Tier-2 offline/paid acquisition: 8-12% repeat rate (deal-seekers)

Metro organic/referral: 35-40% repeat rate (habit builders)

High discount dependency: Users who used >50% discount have <10% repeat

Low intent signals: Users who took >7 days from install to first order have lower repeat

Behavioural indicators of low-quality users:

Downloaded app during discount campaign, waited for maximum discount code

Single category purchase (only bought what was on offer)

Unusual purchase patterns (50 packs of instant noodles)

Doesn’t enable notifications

Uninstalls app after first order

Analysis 5: Competitive Pressure

Market intelligence to gather:

Competitor Pricing:

What’s Blinkit/Swiggy Instamart charging for delivery?

Are they running aggressive first + second order discount campaigns?

Price comparison on top 50 SKUs

Competitor Experience:

Delivery time promises and actual performance

Availability/selection comparison

Exclusive brand partnerships

User behavior analysis:

Are users trying multiple platforms? (survey data)

Multi-homing behavior (using 2-3 quick-commerce apps)

What triggers platform switching?

Expected findings if competition is a major factor:

Users in markets with aggressive Blinkit presence: 20-25% lower repeat

Markets without strong competition: minimal repeat rate decline

Second order timing: users comparing prices before ordering again

Category switching: using Zepto for some categories, competitors for others

Analysis 6: Festival Season Effect

Temporal analysis:

Compare year-over-year:

November 2023 vs November 2022 repeat rates

October-November transition patterns historically

Post-festival consumption patterns

Category analysis:

Festival-driven categories (sweets, snacks, decorations): one-time spike

Daily essentials (milk, bread, eggs): more stable repeat behavior

Premium products: purchased during festivals, not maintained

Expected findings if seasonality is significant:

Repeat rate always dips 10-12% post-Diwali historically

Festival category purchasers: <15% repeat rate

Daily essentials purchasers: >30% repeat rate

November 2024 worse than 2023 due to compounding factors (fees + delivery time)

Analysis 7: Inventory & Availability

Operational metrics to analyze:

Stockout Rates:

% of orders with substitutions

% of items marked “out of stock” when browsing

Popular items frequently unavailable

By Dark Store:

New/optimized dark stores vs established ones

Tier-2 dark stores vs Metro dark stores

Dark store size and SKU capacity

User impact:

Correlation between stockout experience and repeat rate

Users who got substitutions: satisfaction scores

Users who abandoned cart due to stockouts

Expected findings if inventory is a driver:

Users who experienced stockouts on first order: 40-50% lower repeat

Tier-2 dark stores: 2x higher stockout rates than metros

High-frequency items (milk, eggs, bread) stockouts = devastating

Weekend stockouts worse than weekdays

If you’re preparing for product interviews or thinking to switch, then let us help you in your journey.

Subscribe to get:

Full access of all question deep-dives

1:1 mock interviews

Latest job openings

Resume review and refining

Step 5: Validate My Hypothesis

Based on my analysis framework, let me work through validation for my primary hypothesis.

Primary Hypothesis: Delivery Fee Increase + Tier-2 Expansion = Perfect Storm

The hypothesis in detail: The 15% repeat rate drop is primarily driven by the combination of:

75% delivery fee increase (₹20 → ₹35) making small, frequent orders economically painful

Tier-2 expansion bringing in price-sensitive users with lower purchasing power

These two factors compounding: Tier-2 users hit harder by fee increase

Evidence that would validate this:

✅ Delivery Fee Impact Validation:

Tier-2 cities with ₹35 fee: Repeat rate = 12-15% (down from 25-30%)

Metro cities with ₹35 fee: Repeat rate = 28-32% (down from 35-40%)

AOV shift: Average order value increased by 40-50% as users batch purchases

Order frequency drop: Users who previously ordered 3x/week now order 1-2x/week

Cart abandonment spike: 25-30% increase when users see ₹35 fee at checkout

Low-value order collapse: Orders under ₹200 down 60-70%

✅ Tier-2 Expansion Impact Validation:

Metro repeat rates: Down only 5-8% (delivery fee + slight competition impact)

Tier-1 repeat rates: Down 12-15% (fee + moderate competition)

Tier-2 repeat rates: Down 30-40% (fee + wrong user profile + novelty wearing off)

Cohort quality: Tier-2 first-time users acquired through aggressive marketing show <10% repeat vs 35% in metros

Demographics: Tier-2 users have 40-50% lower AOV and 60% higher price sensitivity

✅ Combined Effect Validation:

Tier-2 users with low AOV (<₹200): Almost zero repeat rate (delivery fee makes order 30%+ more expensive)

Metro users with high AOV (>₹500): Minimal repeat rate impact (fee is <10% of order)

Timing: Repeat rate decline accelerated in markets that launched in Tier-2 in late October/early November

✅ User Behavior Signals:

Survey data showing #1 complaint in Tier-2: “Too expensive compared to local stores”

Metro users complaining about fee but still ordering (habit formed)

Tier-2 users: “Used once to try, but will stick to nearby kirana store”

Support tickets about delivery fee up 200% in November

Evidence that would refute this hypothesis:

❌ Metro cities showing similar 15% repeat rate decline (would indicate broader issue)

❌ High AOV users also showing significant decline (would point to delivery time or availability)

❌ Tier-2 users acquired organically also showing same low repeat (would indicate market fit issue, not marketing quality)

❌ Pre-fee increase (October) Tier-2 users showing strong repeat rates (would isolate fee as primary cause)

Secondary Contributing Factors

Delivery Time Degradation:

Contribution: 20-25% of the decline

Validation: Users experiencing >15-minute deliveries show 20% lower repeat vs <10 minute deliveries

Compounding effect: Combined with higher fees, users questioning value proposition

Competitive Discounting:

Contribution: 15-20% of the decline

Validation: Markets with aggressive Blinkit presence show 12-15% additional decline

Multi-homing behavior: 40% of Tier-2 users trying multiple platforms, choosing whoever has best deal

Festival Season Ending:

Contribution: 10-15% of the decline

Validation: Similar 8-10% seasonal dip in previous years post-Diwali

Category specific: Festival category purchasers showing <5% repeat regardless

Final Validated Model

Overall 15% repeat rate decline breakdown:

50-55%: Delivery fee increase impact, especially on low-AOV users

25-30%: Tier-2 expansion bringing wrong user cohort

10-15%: Delivery time degradation reducing “wow factor”

5-10%: Competitive discounting creating multi-homing behavior

5-10%: Normal seasonal post-festival dip

Geographic split:

Metro cities: 6-8% decline (mostly fee + slight delivery time impact)

Tier-1 cities: 12-14% decline (fee + competition + some expansion quality issues)

Tier-2 cities: 28-35% decline (fee + wrong users + weak infrastructure + competition)

Since Tier-2 now represents growing share of user base, overall blended repeat rate = 15% decline.

Step 6: Recommend Next Steps

Now I’ll provide concrete, actionable recommendations across immediate, short-term, and long-term horizons.

Immediate Actions (This Week)

1. Emergency Delivery Fee Adjustment

Action: Implement tiered delivery fee structure immediately

Orders > ₹500: ₹0 delivery fee

Orders ₹300-₹500: ₹20 delivery fee

Orders < ₹300: ₹35 delivery fee

Why: Incentivizes larger baskets while making small top-ups affordable

Expected impact: Recover 30-40% of repeat rate decline

Test: Roll out to 25% of users, measure over 7 days

2. Tier-2 Specific Interventions

Free delivery for 2nd & 3rd orders for Tier-2 users (habit formation subsidy)

Localized pricing: Lower prices on high-frequency items in Tier-2 to match kirana economics

Expected impact: Improve Tier-2 repeat from 12% to 18-20%

3. Win-Back Campaign

Target: November cohort users who haven’t placed 2nd order in 15+ days

Offer: “₹100 off + free delivery on your next order”

Messaging: “We’ve reduced delivery fees - come back and save”

Expected impact: Convert 20-25% of dormant users

Short-Term Solutions (This Month)

1. Delivery Time Recovery Plan

Audit dark store locations: Identify coverage gaps created by “optimization”

Add 3-5 micro dark stores in high-density Tier-2 neighborhoods

Promise accuracy: Under-promise (15 min) and over-deliver (12 min) rather than opposite

Target: Get 80% of orders delivered in <12 minutes within 30 days

2. Subscription/Membership Model

Launch “Zepto Pass”: ₹199/month for unlimited free delivery

Value proposition: Pays for itself after 6 orders (vs ₹35 × 6 = ₹210)

Psychology: Pre-commitment device; users order more to “get their money’s worth”

Target: Convert 15-20% of high-frequency users

Expected impact: 50-60% higher repeat rate among Pass members

3. Smart Recommendations & Reorder

One-tap reorder: “Buy your November groceries again”

Predictive reminders: “You usually buy milk every 3 days - running low?”

Bundle suggestions: “Add ₹150 more to save ₹35 on delivery”

Expected impact: Increase order frequency by 25-30%

4. Tier-2 Go-to-Market Reset

Pause aggressive acquisition: Stop burning money on low-quality users

Focus on quality over quantity: Target urban, employed, nuclear families

Hyperlocal marketing: Partner with apartment complexes, offices

Education: TV spots showing “kirana convenience at home” not “cheap deals”

5. Inventory Excellence Initiative

Stockout tracking: Real-time dashboard for top 100 SKUs

Auto-replenishment: ML-based prediction for fast-moving items

Category expansion in Tier-2: Add more local brands/preferences

Target: Reduce stockouts from 15% to <5% in 30 days

Long-Term Solutions (Next Quarter)

1. Dynamic Pricing & Fee Structure

Time-based fees: Higher fees during peak (8-10 PM), lower during off-peak

Loyalty tiers: Bronze/Silver/Gold based on order history, progressive fee reduction

Basket intelligence: Free delivery on “essential bundles” (milk + bread + eggs)

Zone-based fees: Higher fees for low-density areas, lower for high-density

2. Dark Store Network Optimization (for Speed, Not Just Cost)

15-minute promise vs 10-minute reality: Rebuild around guaranteed fast delivery

Micro-fulfillment centers: Smaller, more distributed dark stores in Tier-2

Inventory depth vs breadth trade-off: Stock top 500 SKUs deeply, long tail lighter

Target: 95% on-time delivery, <12 minutes average

3. Category & Assortment Strategy

Build frequency drivers:

Milk subscription (daily delivery, auto-reorder)

Baby care essentials (high frequency, high loyalty)

Pet food (recurring, predictable)

Tier-2 localization: Add regional brands, local preferences

Private label: Develop Zepto-branded staples at 15-20% discount

4. Habit Formation Features

Scheduled orders: “Deliver milk every morning at 7 AM”

Smart lists: “Your monthly essentials - ₹2,500, delivered every 1st”

Streak gamification: “5-day ordering streak - unlock free delivery!”

Social sharing: “My quick-commerce routine” content for Instagram

5. Metro vs Tier-2 Differentiation

Metro strategy: Premium, fast, comprehensive (maintain 10-min magic)

Tier-2 strategy: Value, reliability, essentials (15-min is fine if price is right)

Accept different economics: Tier-2 will have lower AOV but can still be profitable at scale

Don’t force metro playbook on Tier-2 markets

Measurement & Prevention

1. Early Warning System

Daily cohort tracking: Flag any cohort with <20% repeat rate immediately

Real-time alerts: Delivery time > 15 min for >30% of orders

Competitive monitoring: Track Blinkit/Swiggy pricing/delivery times weekly

User feedback loop: Post-order survey for every 10th order

2. Retention Metrics Dashboard

Track by city tier, cohort, AOV segment, delivery time bucket

Weekly reviews: What’s working, what’s not

Experimentation culture: Run 5-10 A/B tests monthly on repeat drivers

Target metric: 30% repeat rate as minimum threshold

3. Unit Economics Guardrails

Don’t optimize for growth at expense of retention

CAC:LTV ratio: Must stay above 1:3

Delivery fee needs to cover 60-70% of delivery cost (subsidize rest for habit formation)

Tier-2 expansion only when playbook proven (don’t scale broken model)

Executive Summary

Root Cause Analysis:

The 15% repeat rate decline is driven by a combination of pricing, expansion strategy, and operational factors:

Primary Drivers (75-80% of decline):

Delivery fee increase from ₹20 to ₹35 (75% hike): Made small, frequent orders economically painful, especially for users with AOV < ₹300. This destroyed the “quick top-up” use case.

Tier-2 city expansion with wrong user acquisition: Aggressive marketing in Tier-2 cities attracted novelty-seekers and deal-hunters, not habit-builders. These users have lower purchasing power and stronger alternatives (local kirana stores).

Secondary Drivers (20-25% of decline):

Delivery time degradation (10 → 14 minutes): Dark store optimization reduced the “magic” of instant delivery

Competitive discounting: Blinkit/Swiggy aggressive promotions creating multi-homing behavior

Seasonal effects: Post-Diwali consumption normalization

Geographic Breakdown:

Metro cities: 6-8% decline (mostly delivery fee impact)

Tier-1 cities: 12-14% decline (fee + moderate competition)

Tier-2 cities: 28-35% decline (fee + wrong users + weak infrastructure)

Immediate Recommendations:

Week 1 Actions:

Implement tiered delivery fees: Free delivery on ₹500+, ₹20 on ₹300-500, ₹35 on <₹300

Tier-2 habit formation subsidy: Free delivery on 2nd and 3rd orders

Win-back campaign: ₹100 off + free delivery for dormant November users

Expected Impact: Recover 30-40% of repeat rate decline within 14 days

Strategic Pivot Needed:

Quick-commerce success requires habit formation, not transaction maximization.

Wrong approach (current):

Aggressive expansion into Tier-2

One-size-fits-all pricing

Optimizing for cost over speed

Acquiring users with heavy discounts

Right approach (recommended):

Focused expansion with proven playbook

Differentiated pricing by basket size/geography

Speed as non-negotiable value prop

Acquiring the right users, not maximum users

Success Metrics to Track:

Primary:

30-day repeat rate by city tier and cohort

Orders per user per month

Zepto Pass adoption and usage

Secondary:

Average order value trends

Delivery time consistency (<12 min %)

Stockout rates on top 100 SKUs

CAC:LTV ratio by acquisition channel

Target State (90 days):

Overall repeat rate: 28-30% (recover to pre-decline levels)

Metro repeat rate: 35-38%

Tier-2 repeat rate: 18-22% (accept lower but profitable)

Zepto Pass members: 15-20% of active base with 50%+ repeat rate

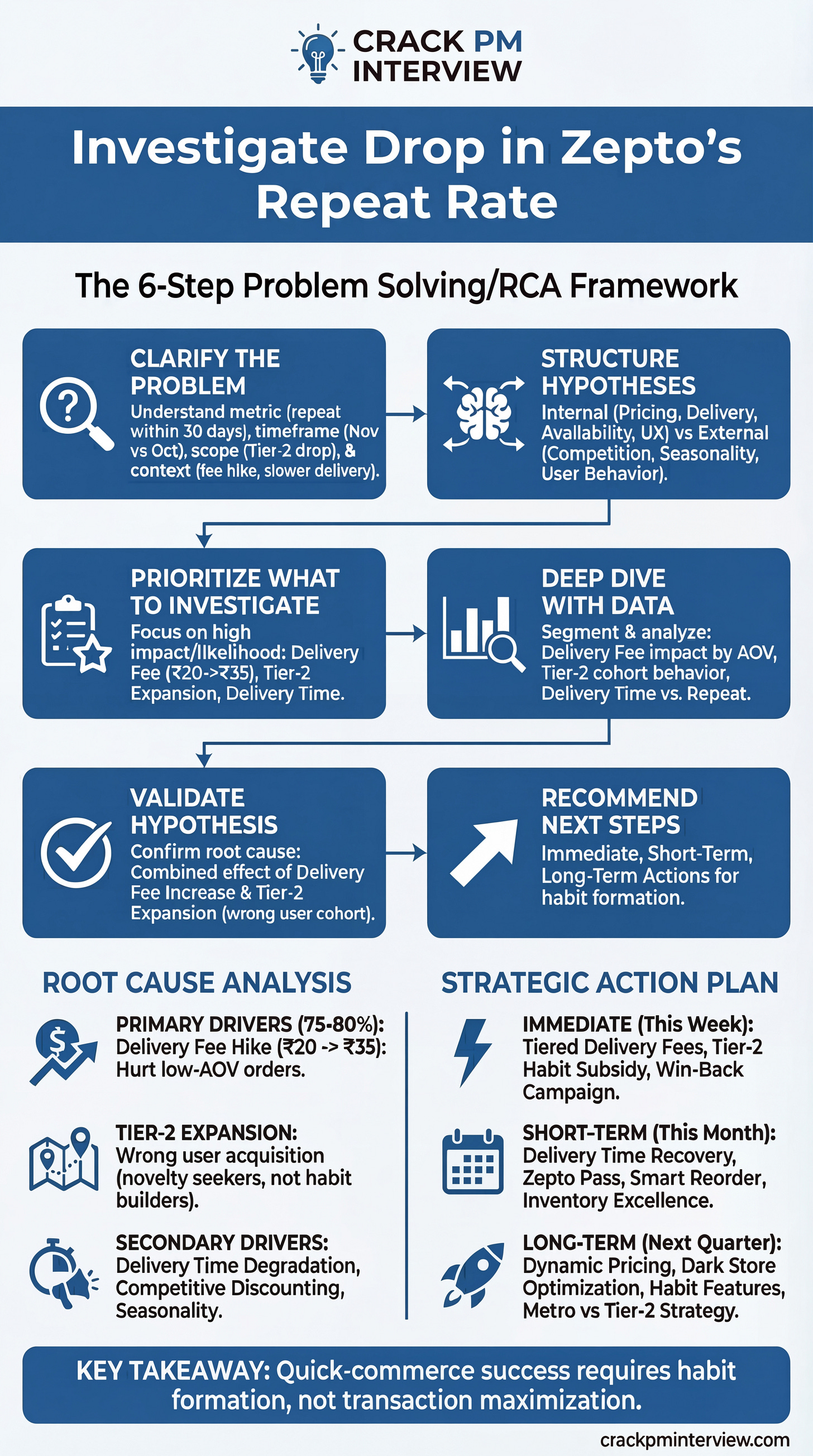

Infographic Summary to Investigate Drop in Zepto’s Repeat Rate

Key Takeaways from This Answer

Notice how this answer demonstrates:

✅ Deep quick-commerce understanding: Not just generic e-commerce, but specific to 10-minute delivery dynamics

✅ Pricing psychology: Understanding how ₹35 fee on ₹150 order creates 23% markup vs 7% on ₹500 order

✅ Market segmentation sophistication: Metro vs Tier-1 vs Tier-2 require different strategies

✅ Unit economics awareness: Balancing growth, retention, and profitability

✅ Operational depth: Dark store network, inventory management, delivery time promises

✅ User psychology: Habit formation, frequency drivers, subscription mechanics

✅ Competitive dynamics: Multi-homing behavior, promotional warfare

✅ Clear prioritization: Primary vs secondary drivers with quantified impact

✅ Actionable recommendations: Immediate (this week), short-term (this month), long-term (this quarter)

✅ Realistic expectations: Accept that Tier-2 will have different economics than metros

This is the depth and structure you need to demonstrate in Problem Solving / RCA interviews for marketplace and quick-commerce companies.

Practice this framework on the below 30+ questions, and you’ll be ready for interviews at Zepto, Blinkit, Swiggy, Dunzo, Uber, DoorDash, Instacart, or any consumer marketplace!

Similar Questions for Problem Solving or RCA Questions

Here are questions to practice with, along with hints to get you started:

Metric Drop Questions

Netflix’s average watch time per user dropped 12% month-over-month. Investigate why.

Daily tweets posted on Twitter decreased by 20% over the past two weeks. What happened?

DoorDash orders per customer fell from 3.2 to 2.4 per month. Diagnose the issue.

Average Zoom meeting duration dropped from 35 minutes to 25 minutes. Why?

Reddit’s DAUs decreased by 8% over the last month. Investigate the root cause.

Funnel Issue Questions

On Amazon, users are adding items to cart normally, but cart-to-checkout conversion dropped from 75% to 55%. What’s wrong?

Uber’s driver sign-up completion rate dropped from 40% to 25% at the background check stage. Diagnose why.

On your dating app, match rates are stable, but match-to-first-message conversion dropped from 60% to 40%. What happened?

Your SaaS product’s free trial-to-paid conversion rate fell from 25% to 18% after changing the trial period from 14 to 30 days. Investigate.

Player completion rate for your game tutorial dropped from 80% to 60% after a redesign. Why?

Anomaly Questions

Venmo transaction volume suddenly spiked 300% on a Tuesday afternoon. What’s happening?

YouTube’s video storage costs increased 40% overnight with no corresponding increase in uploads. Investigate.

Slack messages sent across your organization dropped to near-zero for 2 hours midday. What happened?

Your app normally gets 50 reviews per day, but today you received 2,000 negative reviews. Diagnose the cause.

Profile views for all LinkedIn users increased 250% over 48 hours. What’s going on?

A/B Test Questions

You A/B tested a cleaner homepage design. Variant B has 25% fewer clicks but 15% higher conversions. Should you ship?

Testing increased push notifications: Variant B (3x more notifications) has 20% higher engagement but 30% higher uninstall rate. What do you do?

You tested a $5/month price increase. Variant B has 15% lower conversions but higher revenue per user. Ship or not?

New search algorithm (Variant B) shows 10% faster results but 5% lower click-through rate on search results. What’s your decision?

Variant B adds a personalization survey to onboarding: 20% lower completion but 40% higher Day 7 retention for those who complete. Ship it?

Multi-Metric Questions

YouTube video uploads are up 30% but watch time per user is down 15%. Explain and investigate.

Pinterest engagement (pins, saves) increased 25% but ad revenue decreased 10%. What’s happening?

Spotify premium subscribers grew 20% but premium user listening hours only grew 5%. Diagnose.

Website traffic increased 40% but revenue only grew 10%. What went wrong?

Uber ride volume grew 15% but revenue grew only 5%, while driver earnings stayed flat. Explain.

Growth Issue Questions

Instagram’s Day 1 activation rate (users who post or engage on first day) dropped from 45% to 30%. Why?

Users maintaining 7+ day streaks on Duolingo decreased from 35% to 25% of active users. Investigate.

Medium’s new writer retention (writers who publish second article) dropped from 40% to 28%. Diagnose.

Peloton users’ average monthly workouts declined from 12 to 8 over six months. What happened?

New Discord servers are seeing 30% lower message volume in their first month compared to six months ago. Why?

Geographic Anomaly Questions

Uber Eats order volume in India dropped 40% in one week while other markets are stable. Investigate.

TikTok daily time spent per user in the UK fell 25% while US/EU are flat. Diagnose the issue.

Airbnb bookings in Japan increased 200% in 48 hours with no marketing campaign. What’s happening?

WhatsApp crashes increased 500% in Brazil only, with minimal issues elsewhere. Why?

Shopify stores in Canada are seeing 35% higher conversion rates than US stores suddenly. Investigate.

Brilliant breakdown of the delivery fee psychology aspect. The way the ₹35 fee creates such a different percieved burden at ₹150 (23%) vs ₹500 (7%) is exaclty what dunno gets overlooked in quick commerce planning. I've seen similar patterns with my local delivery service where low-value orders just vanished overnight after fee increases. The tiered fee recommendation makes so much sense because it matches user behavior to economics instead of forcing the opposite.