How Would You Expand and Launch an Existing B2C Product into the B2B Market?

Step-by-step breakdown of expanding and launching a B2C product to to answer GTM (go-to-market strategy) questions in a product manager interview

You’re interviewing for a PM role at a fast-growing consumer-tech company. The interviewer leans forward and asks:

→ “We have 10 million users on our consumer product. How would you expand into B2B?”

This question tests:

strategic thinking,

business model understanding,

market knowledge,

and, execution planning.

For a deep-dive on “How to answer GTM (go-to-market) questions in PM Interview?” - read here to tackle any GTM question.

Join our WhatsApp channel for quick PM insights and latest Job updates

It’s also one of the most realistic questions you’ll face, companies like Slack, Zoom, Dropbox, and Notion all successfully made this transition.

In this post, I’ll break down exactly how to approach B2C to B2B expansion questions using a structured framework, real examples, and actionable insights that will help you nail your next PM interview.

Real-World Success Stories of B2C to B2B transition

Before diving into the framework, let’s look at companies that nailed this transition:

Slack: Started as an internal tool for a gaming company, became a consumer chat app, then dominated enterprise communication. Today, it’s a $27B+ Salesforce acquisition with 750K+ paid business customers.

Zoom: Launched with a generous free tier that went viral, then layered on enterprise features and pricing. Now it’s a $4B+ ARR business with Fortune 500 customers.

Dropbox: Began as simple consumer file storage, noticed teams using shared folders for work, built Dropbox Business. Result: $2B+ revenue with 600K+ business customers.

Canva: Started helping individuals create graphics, expanded to Canva for Teams targeting marketing departments. Now serves millions of business users.

The pattern? They all started with strong consumer adoption, recognized business use cases, and systematically built B2B capabilities.

Understanding B2C and B2B Fundamentals for the Shift

Before breaking down the GTM strategy in your interview, you should understand the fundamental differences between these markets.

If you’re clear about the fundamentals, skip this part and jump straight to the section “How to answer this GTM question” using C-T-P-D-M Framework.

1) Key Differences between B2C and B2B markets

2) Why Companies Make This Shift

The B2B opportunity is compelling:

Higher revenue per customer: A B2B account worth $50K/year vs. $120/year consumer subscription is 400x more valuable.

More predictable revenue: Annual contracts provide visibility and reduce churn volatility.

Lower churn rates: Businesses have higher switching costs, multi-year relationships.

Market expansion: Entirely new TAM (Total Addressable Market) without cannibalizing consumer.

Better unit economics: Higher LTV often justifies CAC that would be unsustainable in consumer.

3) Common Challenges

But the transition isn’t easy and there many challenges of doing this shift. Some are apparent and some are hidden

Product gaps: Missing enterprise features (SSO, admin controls, compliance)

Different value proposition: Personal benefits don’t translate to business ROI

Longer sales cycles: 3-12 months vs. instant consumer signup

Need for sales team: Can’t rely on self-serve alone for $50K+ deals

Brand perception shift: “Consumer toy” to “enterprise-grade platform”

Resource constraints: Building B2B while maintaining consumer growth

Understanding these dynamics shows the interviewer you grasp the strategic complexity.

Now, let’s answer this question

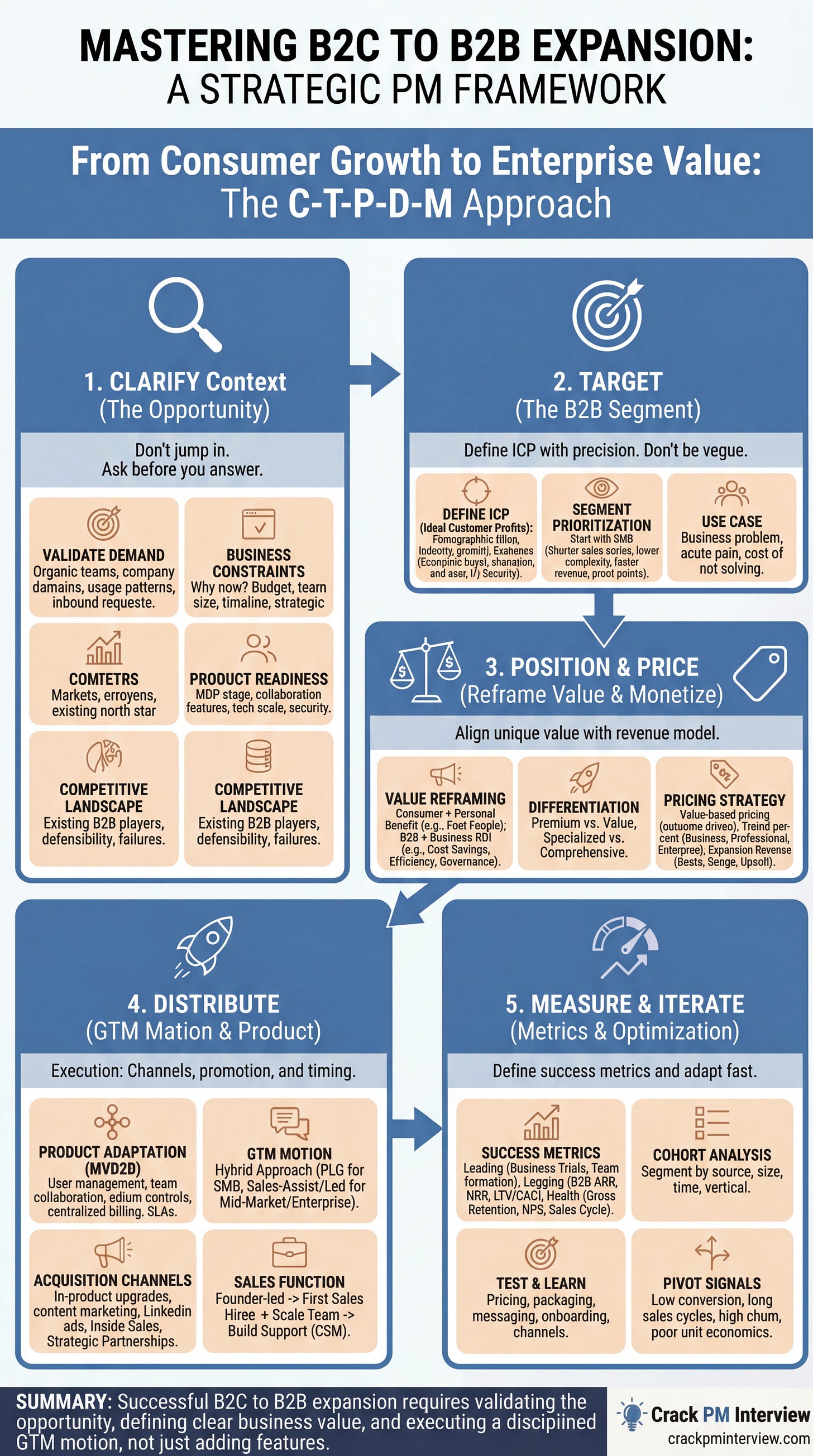

How to Answer GTM Question for B2C to B2B Expansion in a PM Interview?

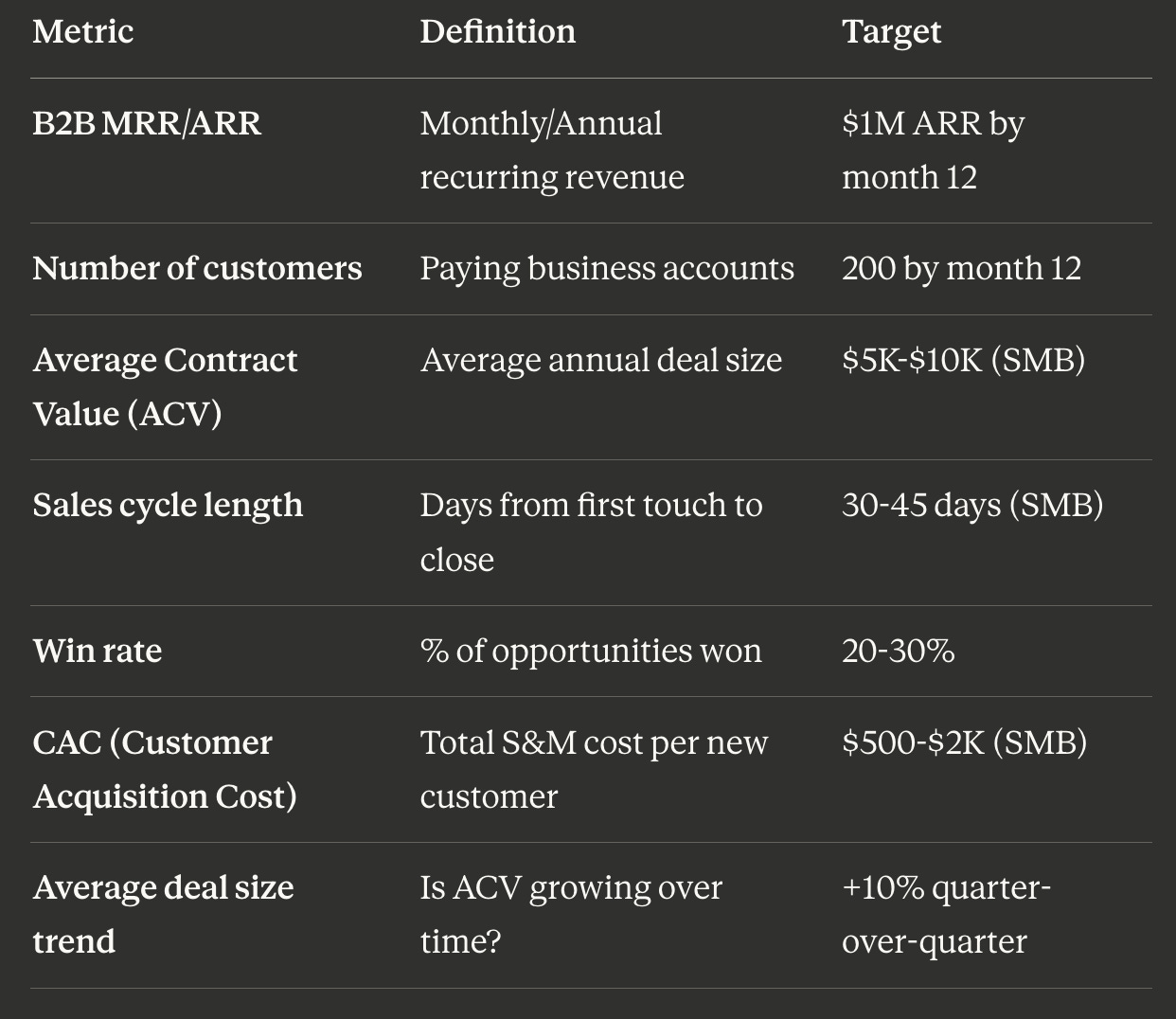

Use the C-T-P-D-M Framework:

Position & Price - How do you want to position and price the product?

This framework gives you a systematic approach to tackle any GTM question in interviews.

Let’s break down each step with detailed guidance on what to consider and how to articulate your thinking.

Step 1: Clarify Context & Validate Opportunity

Never jump straight into “we should build enterprise features.” Start by understanding whether B2B expansion makes sense and what constraints exist.

What to Ask and Why

1) Validate the Opportunity

Do we have organic B2B demand already? Are teams self-organizing on our consumer product?

What percentage of users have company email domains?

Are we seeing patterns like multiple users from the same company?

Have we received inbound requests for business features?

What’s our current B2B penetration, even informally?

Why this matters: Don’t build B2B based on assumptions. If 20% of your 10M users are from 50K companies with 5+ users each, that’s a $1B opportunity. If it’s random individuals with work emails but no team patterns, B2B may not make sense yet.

2) Business Context & Constraints

Why now? Market timing, competitive pressure, consumer growth slowing?

What resources do we have? Budget, team, timeline?

Is this expansion or pivot? Will we maintain both products or sunset consumer?

What’s our north star? Revenue, market share, strategic positioning?

Why this matters: B2B expansion with $5M budget and 18 months allows sales team build-out and enterprise features. With $500K and 6 months, you need lean PLG approach. Understanding constraints shapes your entire strategy.

3) Product Readiness

What’s our current product stage? (MVP, growth, mature)

Do we have basic team/collaboration features already?

What’s our technical infrastructure? Can it handle enterprise scale and security?

How much engineering capacity do we have for B2B features?

Why this matters: If your consumer product barely works and has retention issues, fix that first. B2B won’t save a broken consumer product. You need a solid foundation before expanding upmarket.

4) Competitive Landscape

Are there successful B2B players in this space already?

What’s their positioning and pricing?

Do we have defensible advantages in B2B?

What can we learn from their successes and failures?

Why this matters: If competitors are succeeding with B2B in your category, it validates the market. If they’re struggling or don’t exist, you need to understand why. Maybe the market doesn’t want B2B, or you’ll be a pioneer (higher risk, higher reward).

5) Customer Insights

What do our power users look like? Are they using product for work?

Have we talked to users about willingness to pay for B2B features?

What pain points do business users have that consumers don’t?

Do we have any early adopters or beta customers we can learn from?

Why this matters: Your existing users are your best source of B2B insights. If marketing managers are hacking your consumer product for team use, that’s your signal. If no one’s asking for team features, you may be solving the wrong problem.

Validation Signals to Look For

Strong signals that B2B expansion makes sense:

✅ Organic team formation: 15-20% of users are collaborating with colleagues

✅ Company email patterns: Seeing @company.com domains, not just @gmail.com

✅ Usage patterns: Power users using product for work, not personal use

✅ Inbound demand: Support tickets asking for admin controls, billing, SSO

✅ Competitive success: Others in your category succeeding with B2B

✅ Economic justification: Business use case has clear ROI story

Example of good clarification: “Before outlining a B2B strategy, I’d want to understand our current state:

What percentage of our 10M users have company email domains?

Are we seeing teams naturally form, shared workspaces, or collaboration patterns?

For example, if we notice 500K users from 50K companies, and 20% of those companies have 5+ users, that’s a strong signal.

I’d also ask: have we validated that businesses would pay? What’s driving this, organic demand or strategic initiative?

What resources do we have? Budget, team size, timeline?

And what does success look like in 12 months, revenue target, customer count, or market position?”

This approach shows you don’t make assumptions, you validate before investing.

Step 2: Target - Identify Your B2B Segments

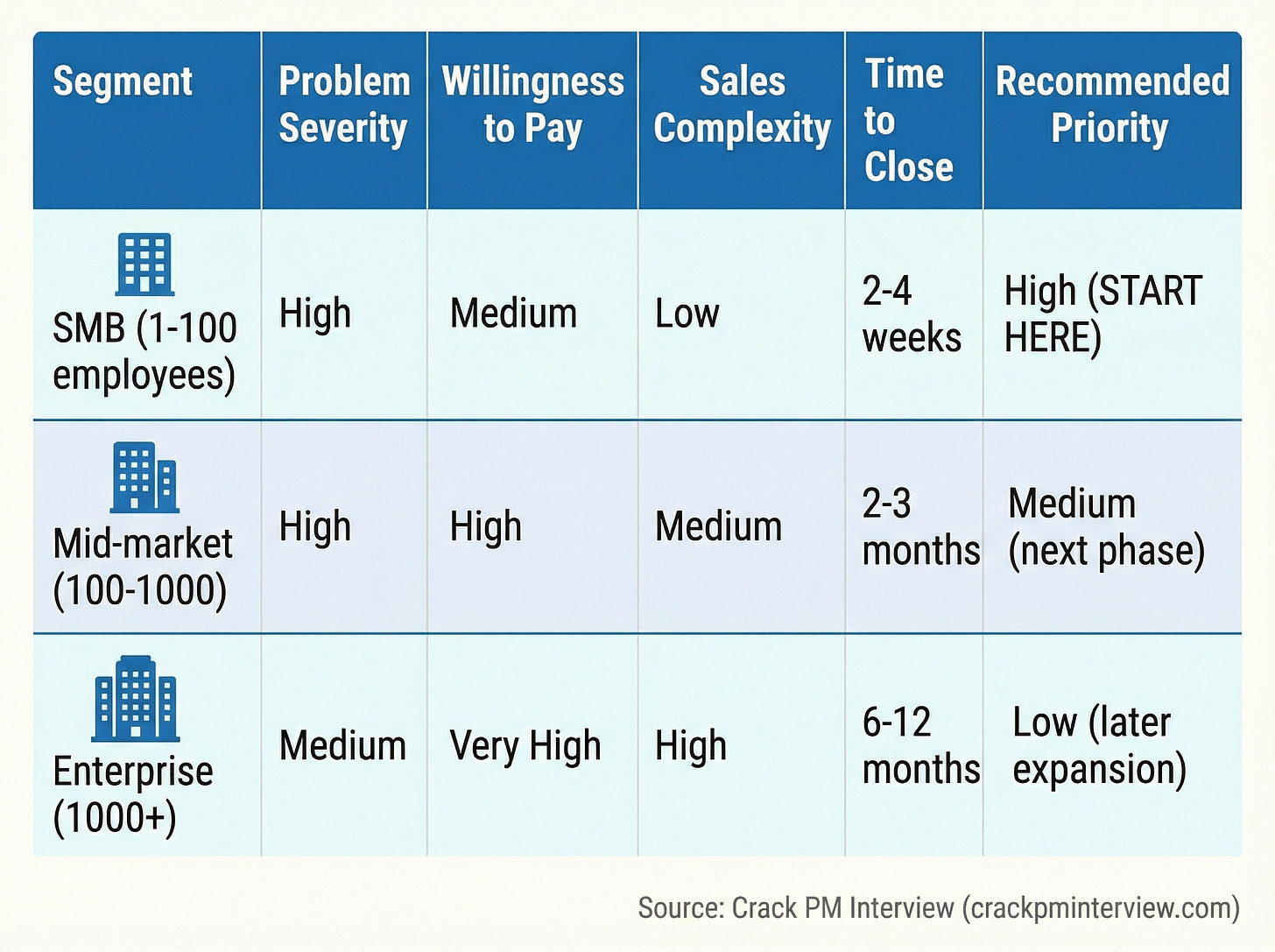

Be specific about who you’re going after first. B2B isn’t monolithic, SMB, mid-market, and enterprise are completely different games.

Define Your B2B ICP (Ideal Customer Profile)

Build your ICP across multiple dimensions:

1) Company firmographics:

Size: Number of employees, revenue range

Industry: Which verticals have the strongest need?

Geography: Starting market (usually home market first)

Growth stage: Startup, growth-stage, mature?

Tech maturity: Early adopters vs. laggards

2) Buyer personas:

Economic buyer: Who has budget authority?

Champion: Who will advocate internally?

End users: Who actually uses the product?

IT/Security: Who needs to approve?

3) Use case and pain points:

What business problem does your product solve?

How acute is the pain? (Nice-to-have vs. must-have)

What’s the current alternative? (Manual process, competitor, DIY)

What’s the cost of not solving this?

4) Buying behavior:

Decision-making process and timeline

Budget cycles (annual planning, quarterly reviews)

Approval requirements (single buyer vs. committee)

Evaluation criteria (security, ROI, ease of use)

Segment Prioritization Framework

Use this matrix to choose your beachhead:

Why Start with SMB?

Most successful B2C to B2B transitions start with SMB because:

Shorter sales cycles: 2-4 weeks vs. 6-12 months for enterprise, faster learning and iteration

Lower complexity: Fewer stakeholders, simpler procurement, less customization needed

Similar to consumer motion: Often self-serve with light sales assist, not full enterprise sales

Faster revenue: Can close 10-20 SMB deals in the time one enterprise deal takes

Build proof points: Case studies and testimonials to move upmarket later

Product validation: Learn what features matter before over-building for enterprise

The strategy: Land SMB → build case studies → expand to mid-market → eventually enterprise.

Example segmentation:

“I’d start with SMB companies, 10-50 employees, in creative and marketing industries.

Why?

First, they’re already using our consumer product individually, we see graphic designers at agencies, marketing managers at startups.

Second, they have clear business pain: brand consistency, collaboration, client deliverables.

Third, decision-maker is often team lead or founder, simple approval process, 2-3 week sales cycle.

Fourth, they have budget, $500-2000/month for tools is reasonable.

This gives us fast learning cycles and builds momentum before tackling enterprise with 9-month sales cycles and complex procurement.”

Step 3: Position & Price - Reframe Your Value

The biggest mistake candidates make: assuming B2B positioning is just “consumer product + team features.”

You need to completely reframe your value proposition.

Repositioning from Personal to Business Value

1) Consumer positioning formula:

“For [individual user] who [personal need/desire], our product is [category] that [personal benefit]”

2) B2B positioning formula:

“For [companies/teams] who [business challenge], our product is [category] that [business outcome/ROI]”

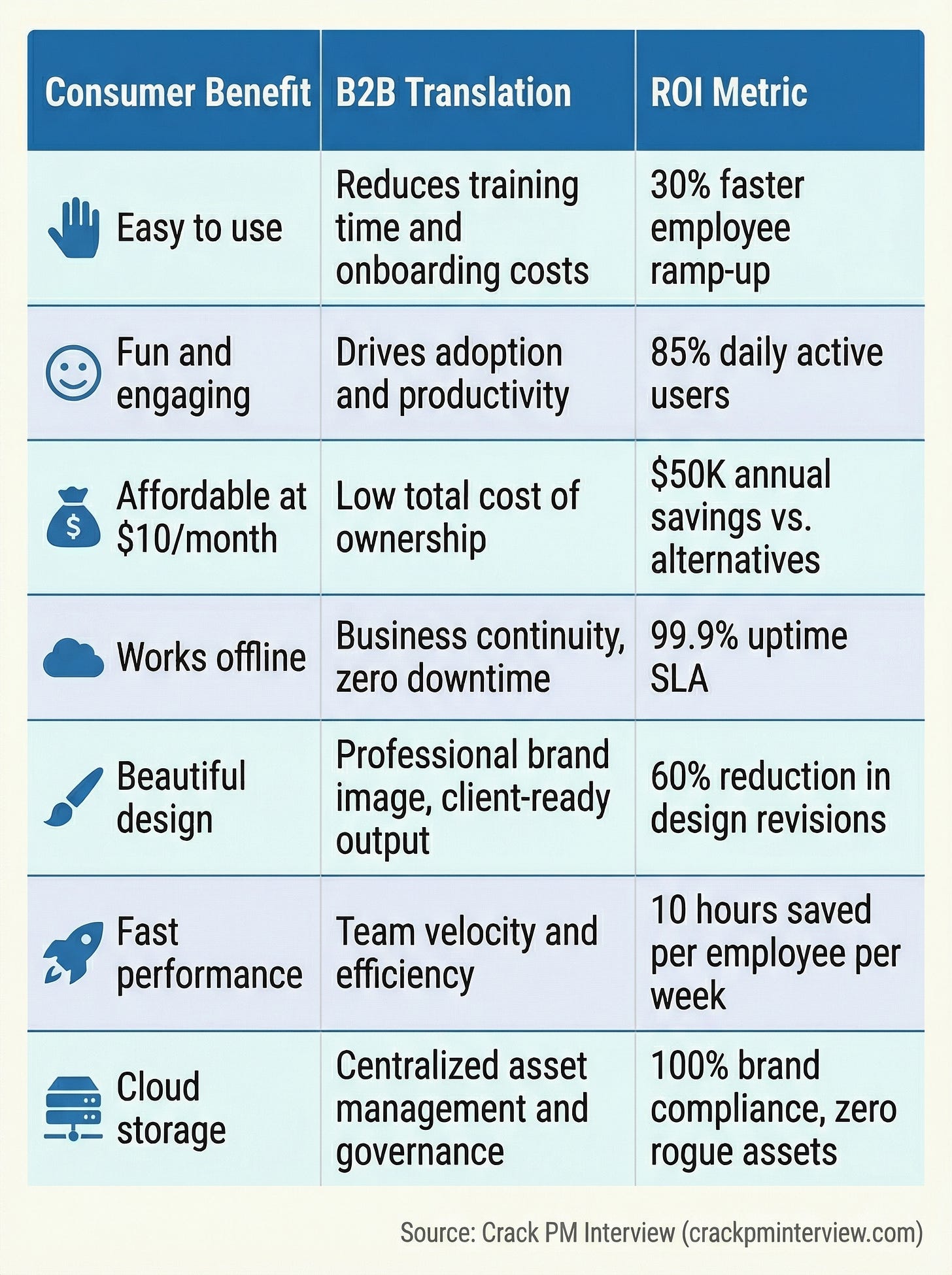

I) Value Translation Table from Consumer Benefit to B2B ROI

The same features mean different things to different buyers:

Real Example: Canva’s Repositioning

Consumer (Canva): “For individuals who want to create beautiful designs without being a designer, Canva is a graphic design tool that makes design simple and fun.”

B2B (Canva for Teams): “For marketing teams struggling with brand consistency and design bottlenecks, Canva for Teams is a brand management platform that empowers everyone to create on-brand content, reducing agency costs by 60% and time-to-market by 10x.”

Notice the shift:

Target: Individual → Marketing team

Pain: Learning curve → Brand consistency + bottlenecks

Category: Design tool → Brand management platform

Benefit: Fun and simple → Cost savings + speed

Proof: Subjective → Quantified ROI

II) Competitive Positioning

Map out your B2B competitive landscape:

Direct competitors: Who offers similar B2B solutions?

Indirect competitors: What substitutes exist? (In-house tools, agencies, manual processes)

Status quo: What happens if they do nothing?

Then position yourself clearly:

Are you premium or value?

Premium: Better features, better support, better outcomes (charge 20-50% more)

Value: Good enough quality at better price (charge 20-30% less)

Are you specialized or comprehensive?

Specialized: Best-in-class for one workflow (deep vertical focus)

Comprehensive: All-in-one platform (horizontal breadth)

Are you innovative or reliable?

Innovative: Cutting-edge features, latest tech (startups, tech-forward)

Reliable: Proven, stable, trusted (enterprises, risk-averse)

Example positioning:

“We’d position as the specialized, premium solution. While Adobe Creative Cloud is a comprehensive suite requiring design expertise, we’re laser-focused on making brand-compliant content creation accessible to non-designers. Yes, we’re 30% more expensive than generic tools like Visme, but our customers see 10x ROI through reduced agency spend and faster content production. Our differentiation is our brand kit and template governance, nobody else makes brand compliance this easy.”

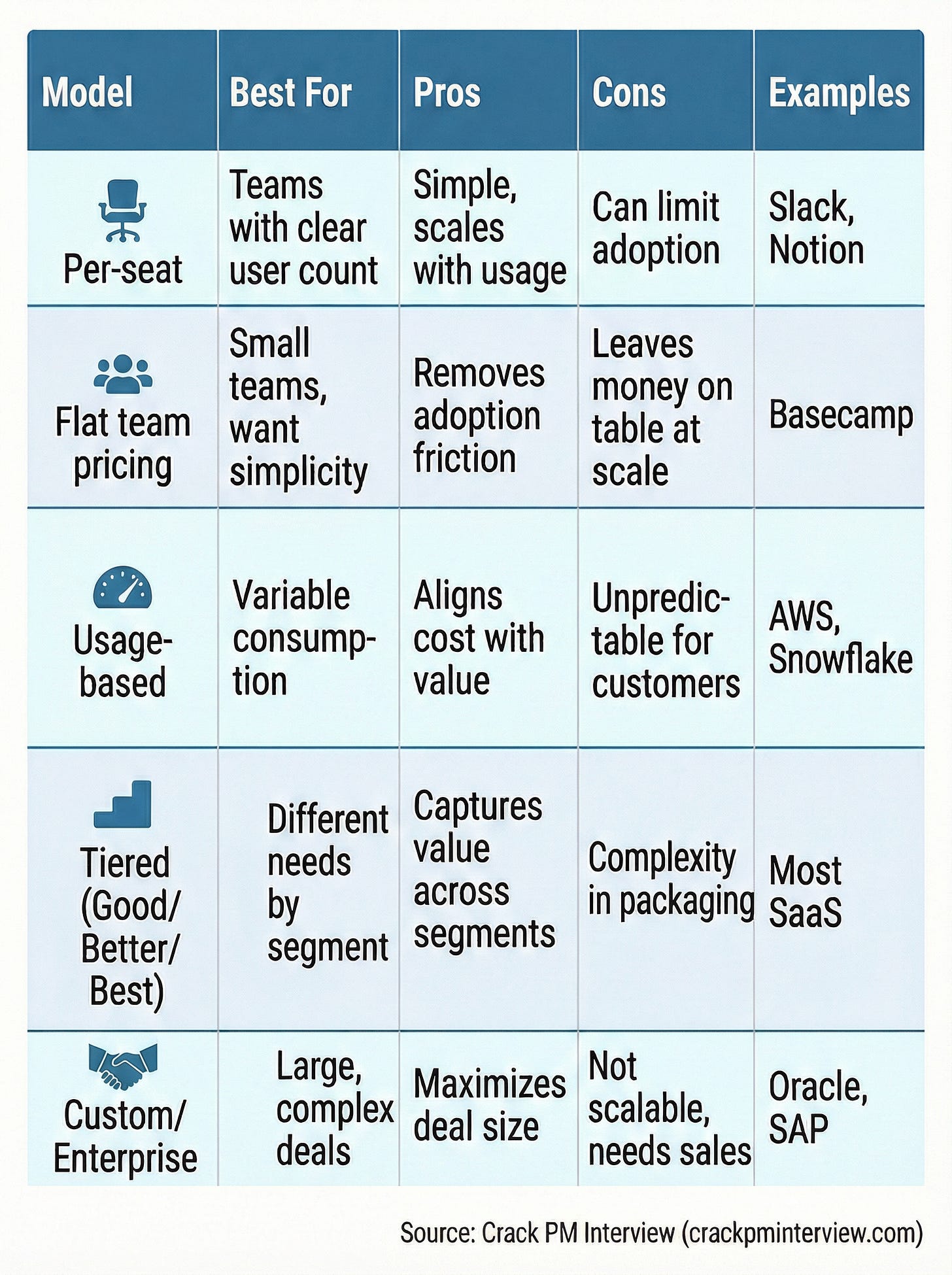

IV) B2B Pricing Strategy

Pricing is where many B2C companies leave money on the table. Don’t anchor to your $10/month consumer price.

1. Choose Your Pricing Model

Recommendation for most B2C→B2B: Start with tiered per-seat pricing, add enterprise custom tier later.

2. Set Your Price Points

Don’t just multiply consumer pricing by seat count. Price based on business value delivered.

Value-based pricing approach:

What’s the customer outcome? (Time saved, cost reduced, revenue increased)

What’s that worth annually? (10 hours/week saved × 10 employees × $50/hour = $260K/year)

What’s a fair value capture? (10-30% of value created)

What do competitors charge? (Validate you’re in range)

Pricing elevation example:

Consumer tier: $12/month individual (stays as-is)

Business tier: $25/user/month, minimum 5 seats = $125/month ($1,500/year)

Professional tier: $50/user/month, minimum 10 seats = $500/month ($6,000/year)

Enterprise tier: Custom pricing, typically $25K-$100K+/year

Notice: Business tier is 2x consumer on a per-user basis, but 10x absolute dollars (5 seats minimum). This is appropriate because business value is 10x higher.

Psychological pricing tactics:

$99 instead of $100 (works in B2B too)

Annual discounts (pay yearly, save 20%, improves cash flow)

Minimum seat requirements (ensures deal size makes economics work)

Custom pricing for enterprise (prevents anchoring, maximizes revenue)

3. Design Your Packaging

What features go where?

Consumer/Free Tier:

Core product functionality

Individual use only

Limited storage/usage

Community support

Self-service only

Business/Team Tier:

Everything in consumer

Admin controls and user management

Team collaboration features

Basic analytics and reporting

Email support

Higher usage limits

Invoicing and PO support

Professional/Scale Tier:

Everything in business

Advanced admin controls (SSO, SAML)

Advanced analytics and insights

API access

Priority support

Custom integrations

Account manager (for larger accounts)

Enterprise Tier:

Everything in professional

Custom SLAs

Dedicated customer success manager

Professional services

Advanced security (SOC 2, HIPAA)

Custom contracts and MSA

Unlimited usage

Training and onboarding programs

4. Strategic Pricing Decisions

Think beyond initial price:

Expansion revenue: Can customers grow with you?

Seat-based pricing naturally expands as team grows

Usage-based expands as consumption increases

Upsell to higher tiers as needs mature

CAC payback: How long to recover acquisition cost?

Target: <12 months for SMB, <18 months for mid-market

If consumer CAC is $50 and B2B CAC is $500, need $500+ in first year

Price testing: Don’t guess, test

A/B test 2-3 price points (±20%)

Monitor conversion, retention, and customer feedback

Measure willingness to pay through sales conversations

Pricing evolution: Plan for the future

Start lower to build market, increase as you add value

Grandfather early customers or migrate with advance notice

Add premium tiers as you move upmarket

Example pricing strategy:

“I’d recommend three tiers: Business at $40/user/month (min 5 seats, $200/month), Professional at $80/user/month (min 10 seats, $800/month), and Enterprise at custom pricing starting around $30K/year. This is 3-4x our consumer $12/month price on a per-user basis, justified by business value: admin controls, brand governance, team analytics, priority support, and SSO. At these prices, with 10% trial-to-paid conversion and $1,000 CAC, we hit 12-month payback. We’d test $40 vs. $50 for Business tier and optimize based on conversion and customer feedback.”

Step 4: Distribute - Build Your B2B GTM Motion

Distribution is where strategy meets execution.

Since you’re expanding an existing B2C product to B2B product, you need to adapt your product, build new channels, and potentially hire a sales & customer-success teams.

I) Product & Feature Adaptation

Before you can sell B2B, you need minimum viable B2B features:

Must-have features (Phase 1):

✅ User management

Add/remove users

Role-based permissions (admin, member, viewer)

User provisioning and de-provisioning

✅ Team collaboration

Shared workspaces

Team libraries or templates

@mentions and notifications

Activity feeds

✅ Admin controls

Usage dashboards

User activity monitoring

Content governance

Data retention policies

✅ Billing and accounts

Centralized billing

Invoice and PO support

Multiple payment methods

Seat management

✅ Support and SLAs

Priority support channel

Dedicated account contact (for larger customers)

Response time guarantees

Nice-to-have features (add in phase 2, 3, 4):

💡 Interview Tip:

Don’t try to build everything at once. Explain your phasing: “We’d ship MVB2B in 3 months with admin controls, team features, and invoicing. Then iterate based on customer feedback. SSO and advanced security come in Phase 2 once we have 50+ customers proving demand.”

II) Choose Your GTM Motion

You have three main options:

Option A: Bottom-Up (Product-Led Growth for B2B)

How it works:

Individual users adopt for personal use

They invite colleagues, teams form organically

Usage patterns trigger sales outreach

Light sales assist to convert to paid business accounts

Best for:

SMB and mid-market

Products with natural viral mechanics

Low complexity, easy to understand

$5K-$25K ACV

Examples: Slack, Figma, Notion, Miro

Advantages:

Leverage existing consumer adoption

Lower CAC, users sell themselves

Faster sales cycles (product already adopted)

Scalable, doesn’t require large sales team

Challenges:

Requires product virality

Hard to force team adoption

May need sales team for larger deals anyway

Option B: Top-Down (Sales-Led)

How it works:

Outbound prospecting to target accounts

Demos and POCs (proof of concept)

Navigate buying committee

Negotiate contracts and close deals

Best for:

Enterprise and large mid-market

Complex, high-touch products

$50K+ ACV

New market where you lack brand awareness

Examples: Salesforce, Workday, ServiceNow

Advantages:

Control the sales process

Can target specific high-value accounts

Build relationships with decision-makers

Maximize deal size

Challenges:

High CAC (expensive sales team)

Long sales cycles (6-12 months)

Doesn’t scale without large investment

Requires enterprise-ready product

Option C: Hybrid (Recommended for Most)

How it works:

Product-led for acquisition and activation

Sales-assist for conversion and expansion

Self-serve for SMB, sales for mid-market+

Best for:

Most B2C to B2B transitions

$10K-$100K ACV range

Want to serve both SMB and enterprise

Examples: Zoom, Dropbox, Calendly, Loom

Motion:

Individual users sign up (freemium or free trial)

They use product, invite colleagues

Team hits usage threshold (product-qualified lead)

Inside sales reaches out to convert

Account manager drives expansion

Advantages:

Best of both worlds

Efficient customer acquisition (PLG)

Maximize revenue (sales assist)

Scalable across segments

Challenges:

More complex to execute

Need both product virality AND sales capability

Coordination between product and sales

Example GTM motion selection:

“I’d recommend a hybrid approach. For SMB (under 50 employees), pure product-led: self-serve trial, automated onboarding, in-product upgrade prompts when teams hit 5+ users. For mid-market (50-500 employees), product-qualified leads get routed to inside sales for demo and conversion. For enterprise (500+), outbound sales with strategic account approach. This gives us efficient SMB acquisition while capturing high-value mid-market and enterprise deals through sales. We’d start with 2 inside sales reps and scale based on pipeline.”

III) Build Your Acquisition Channels

How will B2B customers discover and evaluate your product?

Channel strategy by segment:

For SMB:

Upgrade existing consumer users (warmest leads)

Content marketing (SEO, blog posts, case studies)

LinkedIn ads targeting decision-makers

Product-led viral loops (invite colleagues)

Partnerships and integrations

Community and word-of-mouth

For Mid-Market:

Inside sales outreach (SDRs, BDRs)

Targeted ABM (account-based marketing)

Industry events and conferences

Webinars and virtual events

Partner referrals

LinkedIn and paid ads

For Enterprise:

Field sales and account executives

Strategic partnerships

Analyst relations (Gartner, Forrester)

Executive events

RFP responses

Channel partners and resellers

Channel prioritization:

Phase 1 (Months 0-6): Low-hanging fruit

Upgrade existing users - Target teams already using product

In-product prompts - Upgrade flows when team patterns detected

LinkedIn ads - Targeted campaigns to decision-makers

Content marketing - SEO-optimized content on business use cases

Phase 2 (Months 6-12): Build sales capacity

Inside sales team - 2-3 AEs for inbound and warm outreach

Partnerships - Integrate with business tools (Slack, Teams, Salesforce)

Webinars - Educational content, lead generation

Customer referrals - Incentivize existing customers

Phase 3 (Months 12+): Scale what works

Expand sales team - More AEs, add SDRs for outbound

Events and conferences - Industry presence, booth sponsorships

Channel partners - Resellers for specific verticals

Enterprise ABM - Target high-value accounts strategically

IV) Build Your Sales-Function

If you’re doing any sales-assist or sales-led motion, you need to build the function:

Phase 1: Founder-led sales (Months 0-3)

Founders or PM do initial deals

Goal: Learn, establish playbook, prove model

Close 5-10 deals manually

Document what works

Phase 2: First sales hires (Months 3-9)

Hire 1-2 generalist AEs (Account Executives)

Hire sales leader or experienced IC

Define territories and quotas

Build sales enablement materials

Phase 3: Scale the team (Months 9-18)

Hire sales manager or VP Sales

Add 3-5 more AEs

Add SDRs (Sales Development Reps) for outbound

Specialize roles (SMB vs. mid-market vs. enterprise)

Phase 4: Build supporting functions (18+ months)

Sales operations

Sales engineers / solution consultants

Channel and partnerships

Revenue operations

Sales team structure example:

Month 6 team:

1 Head of Sales

2 Account Executives (quota: $500K ARR each)

1 Sales Operations / enablement

Month 12 team:

1 VP Sales

5 Account Executives (3 SMB, 2 mid-market)

2 SDRs generating pipeline

1 Sales Engineer for demos

1 Sales Operations

Month 24 team:

1 VP Sales

10 Account Executives (segmented by market)

5 SDRs

2 Sales Engineers

2 Customer Success Managers

2 Sales Operations

V) Build Customer Success & Support Function

B2B customers expect more than self-service support:

Support structure:

SMB:

Email support with 24-hour SLA

Help center and documentation

Community forum

Chat support during business hours

Mid-Market:

Dedicated account manager (pooled, 1:50 ratio)

Priority email and chat support (4-hour SLA)

Quarterly business reviews

Onboarding assistance

Enterprise:

Dedicated CSM (1:10 to 1:20 ratio)

Named support contact

1-hour critical issue SLA

Custom onboarding and training

Executive business reviews (QBRs)

Success planning and optimization

Customer Success motions:

Onboarding:

Self-serve (SMB): Email series, video tutorials, template libraries

Guided (Mid-market): 30-minute kickoff call, setup assistance

White-glove (Enterprise): Multi-week onboarding program, training sessions

Adoption and expansion:

Usage monitoring and health scores

Proactive outreach for low adoption

Upsell opportunities (more seats, higher tier)

Cross-sell to other teams/departments

Renewal and retention:

90-day renewal outreach

Address concerns and objections

Demonstrate value and ROI

Negotiate multi-year agreements

Example distribution and team strategy:

“Phase 1 (Months 1-6): Focus on upgrading existing power users. Build in-product prompts when 3+ users from same company domain detected. Create ‘Invite Team’ flow with admin onboarding. Hire 1 sales leader and 2 inside sales AEs to handle inbound and warm outreach. Launch LinkedIn campaign targeting marketing managers at 50-500 person companies. Goal: 50 business customers, $300K ARR, learn what converts.

Phase 2 (Months 6-12): Add 3 more AEs, 2 SDRs for outbound. Build sales playbook based on Phase 1 learnings. Launch partner integrations with Slack and Microsoft Teams. Start webinar series on brand management best practices. Add Customer Success Manager for mid-market accounts. Goal: 200 business customers, $1.5M ARR.

Phase 3 (12+ months): Scale what’s working. Expand sales team to 10+ AEs, segment by customer size. Launch enterprise pilot program with field sales. Build channel partnerships. Invest in events and conferences. Goal: $5M+ ARR, clear path to $20M.”

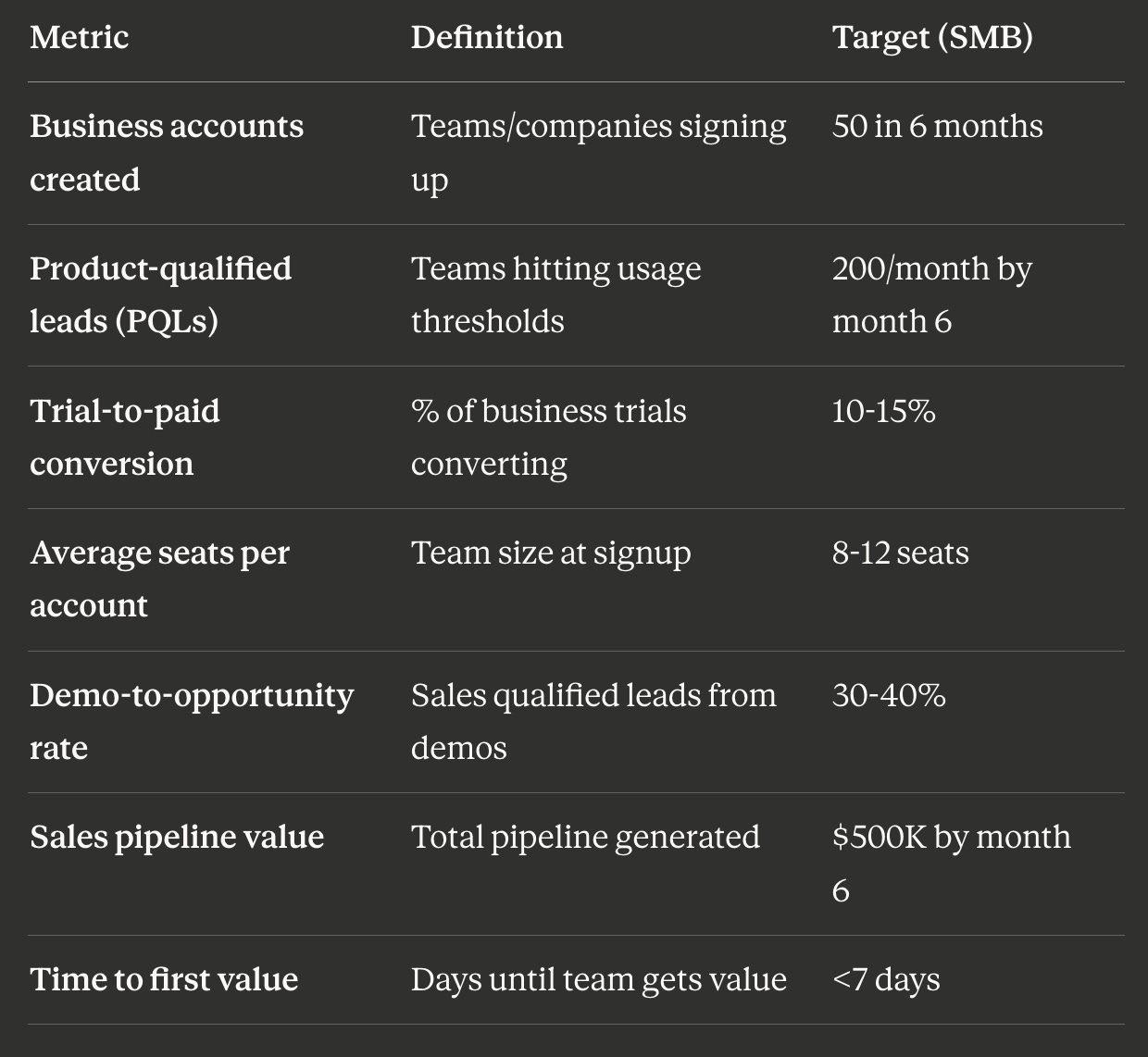

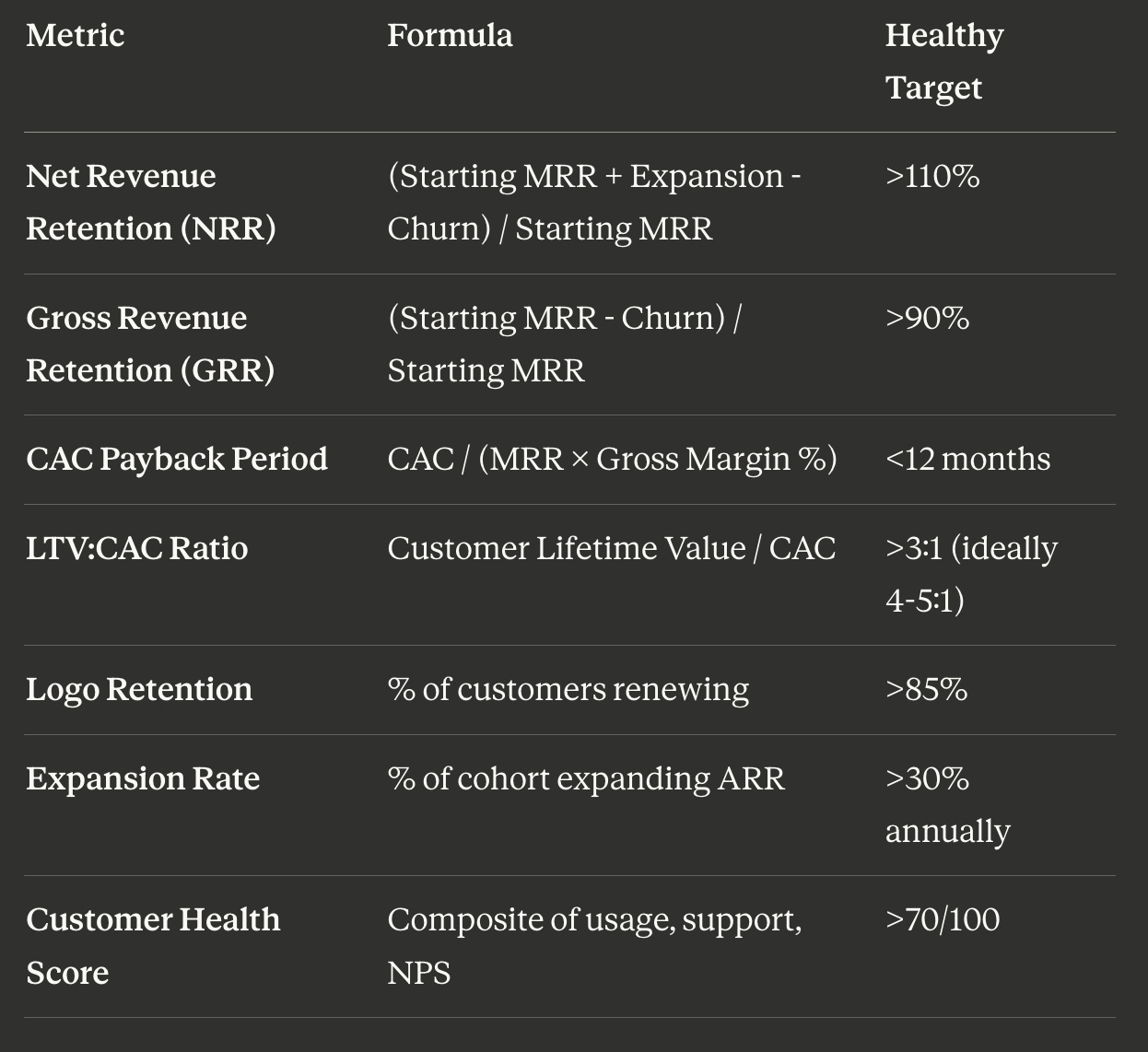

Step 5: Measure & Iterate

You can’t improve what you don’t measure. B2B success metrics are fundamentally different from consumer metrics.

I) Success Metrics for B2C to B2B Expansion

Track three categories: leading indicators, lagging indicators, and long-term health.

1. Leading Indicators (0-6 Months)

These tell you if your motion is working early:

Why these matter: They predict future revenue and validate product-market fit before you have revenue scale.

2. Lagging Indicators (6-12 Months)

These measure commercial success:

Why these matter: They show you’re building a real business with sustainable unit economics.

3. Long-term Health Metrics (12+ Months)

These determine if the business is durable:

Why these matter: They prove long-term viability and determine whether you can scale profitably.

II) Cohort Analysis

Don’t just look at aggregates. Segment your data:

By acquisition source:

Organic B2B (existing consumer users upgrading)

New B2B customers (never used consumer)

Partner-referred

Sales-sourced vs. product-led

By customer segment:

SMB (1-50 employees)

Mid-market (50-500)

Enterprise (500+)

By time period:

Q1 2024 cohort vs. Q2 2024 cohort

Track improvement in metrics over time

By vertical:

Marketing agencies vs. tech companies vs. professional services

Which industries have best retention and expansion?

Example analysis:

“Q1 cohort: 50 customers, $250K ARR, 60% from consumer upgrades, 40% new. Trial-to-paid: 8%. 6-month retention: 85%. Q2 cohort: 80 customers, $450K ARR, 70% consumer upgrades, 30% new. Trial-to-paid: 12% (improving!). Hypothesis: Consumer-upgrade customers have better retention (90% vs. 75%) and faster time-to-value (3 days vs. 10 days). Recommendation: Double down on in-product upgrade flows.”

III) Define Success at Key Milestones

Be specific about what success looks like at each stage:

6-Month Success:

50 paying business customers

$300K ARR ($5K average ACV)

12% trial-to-paid conversion

85% gross retention

30-day average sales cycle

$500K pipeline generated

These would indicate: Product-market fit, repeatable sales motion, healthy unit economics foundation

12-Month Success:

200 paying business customers

$1.5M ARR ($7.5K average ACV, improving)

15% trial-to-paid conversion

90% gross retention, >100% net retention

CAC payback <12 months

LTV:CAC >3:1

Clear segmentation (SMB playbook working)

These would indicate: Scalable business, ready for investment in growth

24-Month Success:

500+ paying business customers

$5M+ ARR

Expanding upmarket ($15K+ ACV for mid-market)

110% NRR

<10 month CAC payback

4:1 LTV:CAC

Proven expansion motion (land-and-expand working)

These would indicate: Sustainable growth, ready for next phase (enterprise, international)

Example success definition:

“I’d define launch success at 12 months as: $2M B2B ARR, 250 business customers, $8K average ACV, 45-day sales cycle, 90% gross retention, >105% net retention, and CAC payback under 12 months. Leading indicators at 6 months that predict this: 500 business trials started, 15% trial-to-paid, 50 closed customers, $1M pipeline, strong usage signals (60%+ teams using product 4+ days per week). I’d track cohorts monthly to spot retention or expansion issues early.”

IV) Test, Learn & Iteration

What to test and optimize:

Pricing experiments:

A/B test price points (±20%)

Test annual vs. monthly default

Experiment with seat minimums

Trial different free trial lengths (7 vs. 14 vs. 30 days)

Packaging tests:

Which features drive most conversions?

Where should SSO live? (Business vs. Enterprise)

Test freemium vs. free trial approach

Sales and marketing:

Message testing (ROI-focused vs. productivity-focused)

Channel optimization (which channels have best CAC and LTV?)

Sales process refinement (demo scripts, objection handling)

Product optimizations:

Onboarding flow iterations

Feature adoption campaigns

Activation milestone testing

Example test plan:

“Month 3-4: Test pricing - run $40/user vs. $50/user for Business tier, measure trial-to-paid and customer feedback. Hypothesis: $50 is optimal, minimal conversion impact but 25% more revenue.

Month 5-6: Test onboarding - Version A is self-serve email series, Version B adds 15-minute kickoff call. Measure activation rate and time-to-value.

Month 7-8: Test channels - Allocate $20K across LinkedIn ads, content syndication, and webinars. Measure CAC and 90-day retention by channel.

Month 9-10: Test sales approach - Version A is demo-heavy (45 min), Version B is consultative (discovery call + tailored demo). Measure win rate and sales cycle length.”

We share only vetted PM jobs on our whatsApp channel.

When to Pivot

Know your red flags and decision points:

🚩 Red flags at 6 months:

Trial-to-paid conversion <5% (should be 10-15%)

Sales cycles >6 months for SMB (should be 4-8 weeks)

Monthly churn >10% (should be <5%)

CAC >$5K for <$10K ACV (unit economics broken)

No clear ICP emerging (too scattered)

Product usage declining post-purchase (not sticky)

Decision framework:

Small pivots (adjust within strategy):

Refine messaging and positioning

Adjust pricing by 10-20%

Target different verticals within SMB

Modify sales process and enablement

Medium pivots (change GTM motion):

Shift from PLG to sales-led (or vice versa)

Change segment focus (SMB to mid-market)

Adjust from annual to monthly contracts

Partner-led vs. direct sales

Large pivots (reconsider strategy):

Pause B2B expansion, focus on consumer

Complete business model change

Sunset product and focus elsewhere

Timeline: Give each major hypothesis 90 days before pivoting. Small optimizations can happen continuously.

Example pivot scenario:

“If after 6 months we have: 4% trial-to-paid (target 12%), 20% monthly churn (target <5%), and sales cycles averaging 4 months (target 6 weeks), I’d diagnose: product isn’t sticky enough for B2B. Pivot: Pause new customer acquisition, focus existing customers on identifying what drives retention. Interview churned customers. Hypothesis: Missing critical features or targeting wrong segment. Test: Run pilot with 10 high-fit customers, build must-have features, prove retention, then relaunch. Don’t scale a broken model.”

Infographic Summary

Common Pitfalls to Avoid ⚠️

Even with a solid framework, candidates often make predictable mistakes. Here’s what to watch for:

Building for enterprise too early.

Cannibalizing your consumer business.

Underpricing B2B. Just because consumer is $10/month doesn’t mean business should be $15/month. B2B value is 5-10x higher. Price accordingly. Typical multiplier: 3-5x on a per-user basis.

Ignoring your existing users. Your warmest B2B leads are already using your product. Convert them first before spending on cold acquisition. 20% of your effort should get 80% of initial customers.

Over-engineering the product. Ship MVB2B (minimum viable B2B): admin controls, team features, invoicing. Don’t wait for perfect.

Wrong sales motion for your ACV. $5K ACV doesn’t support field sales with $200K fully-loaded costs. $100K ACV can’t be self-serve only. Match sales investment to deal size.

No clear upgrade path from consumer. Make it seamless for individuals to become teams. One-click upgrade, data migration, simple onboarding. Friction kills conversion.

Measuring with consumer metrics. Daily active users matter less than business outcomes. Track: productivity gains, cost savings, ROI, time saved. Speak the language of business value.

Trying to serve all segments simultaneously.

Neglecting security and compliance.

Assuming B2B is just “teams version.” It’s a different business model: longer sales cycles, different buyers, committee decisions, ROI justification, procurement processes. Respect the complexity.

Key Insight: The B2C to B2B transition isn’t just adding features, it’s a fundamental shift in how you create value, price, sell, and support customers. Treat it as a new business within your business, not a feature launch.

We share only vetted PM jobs on our whatsApp channel.

Pro Tips for Success ✅

Here are battle-tested tips that will elevate your answer in GTM interviews:

Quantify the opportunity.

Explain your GTM motion choice. “Given our $8K ACV and existing consumer adoption, I’d use hybrid PLG. Pure self-serve can’t provide onboarding needed. Pure sales-led is too expensive for $8K deals. Hybrid gives us efficient acquisition through product plus conversion help through inside sales.”

Talk about expansion revenue.

Show iteration mindset.

Mention the organizational implications. “This isn’t just a product change. We need to: hire sales team, build customer success function, add enterprise features, create B2B marketing, adjust company metrics. I’d recommend a dedicated B2B squad with P&L ownership reporting to CPO or CEO.”

Use real company examples. “Similar to how Zoom kept 40-minute free tier but added Enterprise with SSO and phone integration. Or how Slack maintained generous free tier but Business added message history and integrations.”

End with clear success metrics.

Study real B2B transitions. Read how Slack, Zoom, Dropbox, Notion, Figma, Miro, Loom all made this shift. Understand their pricing, GTM motion, timeline, challenges. Reference them in your answer.

I’ll release four real-world case studies for “B2C to B2B transition/expansion” this week. Subscribe to get directly in your mailboxes

Practice the full answer.

Key Insight: Interviewers want to see strategic thinking, business acumen, and execution planning. The best answers blend market analysis, customer understanding, pricing strategy, and realistic GTM planning. Show you can think like a CEO, not just a feature PM.

Success formula: Consumer foundation + clear business value + smart segmentation + hybrid GTM + patient execution = B2B expansion success.

Practice Questions

For B2C to B2B Expansion

Test your understanding with these B2C to B2B expansion questions:

Spotify wants to expand Spotify into businesses (Spotify for Work - background music for retail/restaurants). How would you approach this?

You’re a PM at Notion. You notice 40% of users have company email domains but are on personal plans. What’s your B2B strategy?

Duolingo is considering a B2B product for corporate language training. How would you validate this opportunity?

Headspace (meditation app) wants to sell to companies for employee wellness. How would you price a B2B tier?

You’re launching a B2B tier for a consumer fitness app. What features would you prioritize in MVB2B?

Your consumer photo editing app has 5M users. You want to expand to professional photographers and design studios. What’s your distribution strategy?

Case Study Questions

Discord started as a gaming chat platform and is now used by businesses, communities, and study groups. If you were a PM there, how would you approach formal B2B expansion?

Strava (fitness tracking) has organic adoption among cycling clubs and running groups. Design a B2B strategy for sports teams, corporate wellness, and coaching businesses.

You’re at Pinterest. You notice small businesses and brands using Pinterest organically for marketing. How would you build Pinterest Business Suite (beyond just ads)?

Venmo is considering Venmo for Business for freelancers, small businesses accepting payments. How would you compete with Square, Stripe, and PayPal while leveraging your consumer network?

Other GTM Questions

You’re launching a project management tool in a crowded market with Asana, Monday.com, and Jira. How would you go to market?

How would you expand an existing B2C product into the B2B market?

You have a $500K marketing budget for your product launch. How would you allocate it?

How would you launch a product in a completely new market where no alternatives exist?

Your product has great retention but low acquisition. What would be your GTM strategy?

You’re the PM for Stripe launching in a new country (e.g., India). Walk me through your GTM strategy.

How would you launch a freemium product where the free tier cannibalizes potential paid customers?

You’re launching an AI-powered recruiting tool. Your primary competitor just dropped their prices by 40%. How does this change your GTM?

Design a GTM strategy for a hardware product (smart home device) that also has a software component.

You have limited engineering resources and can only build 50% of your planned features for launch. How does this impact your GTM strategy?

Checkout our deep-dive on How to answer any GTM question in a PM Interview