Why Has Meta Acquired Manus AI? - A Product Strategy Interview Guide for PMs

Step-by-step approach to tackle acquisition / strategy questions in a product management interview.

You’re in the final round of interviews at your dream company. The interviewer leans back and asks:

“Meta just acquired Manus AI, an 8-month-old autonomous AI agent startup, for $2-3 billion. In your view, why did Meta make this acquisition?”

Your palms get a little sweaty. You’ve seen the headlines about Manus, maybe even tried it. But now you need to deliver a structured, strategic answer that shows you think like a product leader, not just recite what you read on TechCrunch.

For a deep-dive on “How to answer Product Strategy questions in PM Interview?” - read here to tackle any product strategy question.

Join our WhatsApp channel for quick PM insights and latest Job updates

Here’s the thing: this type of question isn’t about knowing every detail. It’s about demonstrating:

strategic thinking,

structuring your analysis,

connect business strategy to user value,

evaluate alternatives and articulate why one path was chosen over others

and, balancing multiple perspectives.

The interviewer wants to see HOW you think, not whether you memorized acquisition announcements.

In this guide, you’ll learn:

How to think through Business Objectives, User Needs, and Solutions

Pro tips for success

By the end, you’ll have a replicable approach for any “Why did Company X acquire Company Y?” question in PM interviews.

Let’s break it down.

How to answer acquisition questions in a PM interview?

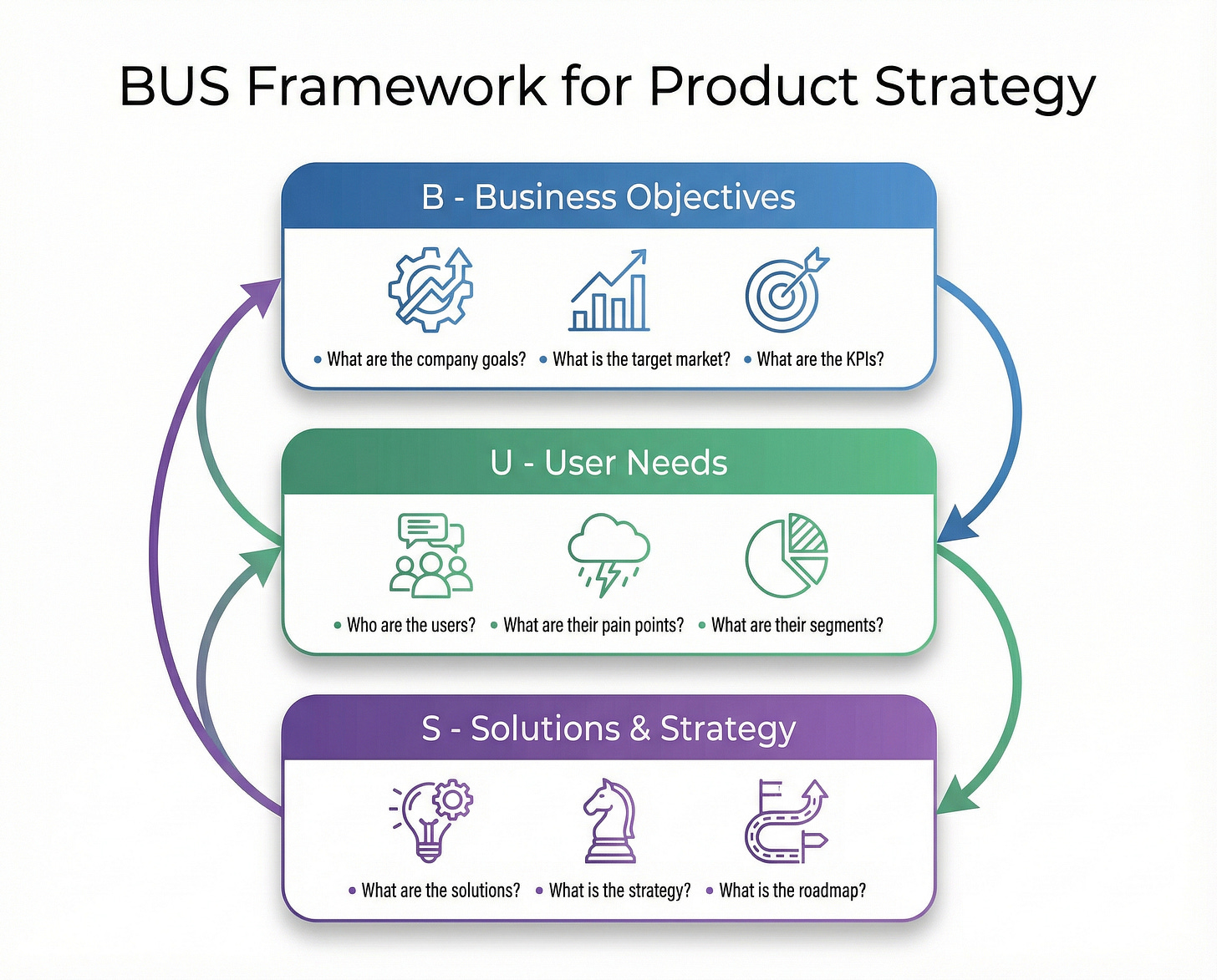

For acquisition questions, the BUS framework (Business Objectives, User Needs, Solutions & Strategy) works perfectly. Here’s how to apply it:

What business problems was Meta trying to solve?

What strategic goals does this acquisition serve?

Why was this urgent (timing)?

What user problems does Manus solve?

How does this improve Meta’s value proposition to users?

Which user segments benefit?

Why acquire vs. build in-house or partner?

What alternatives did Meta likely consider?

Was this the right strategic choice?

Keep reading with a 7-day free trial

Subscribe to Crack PM Interview to keep reading this post and get 7 days of free access to the full post archives.