How to Answer GTM Questions in a PM Interview? - Essential Guide for Product Managers

Step-by-step process to answer GTM (go-to-market strategy) questions in a product manager interview

Go-to-market (GTM) questions are among the most revealing parts of a product person in an interview. They’re not just testing whether you can launch a product, they’re evaluating:

how you think strategically,

understand markets, and

orchestrate cross-functional teams to drive business outcomes.

If you’ve ever frozen or fumbled when asked “How would you launch this product?”, you’re not alone.

GTM questions can feel overwhelming because they span so many domains: marketing, sales, pricing, distribution, and more.

But, with the right framework and practice, you can turn these questions into opportunities to showcase your strategic thinking.

In this post, I’ll break down exactly how to approach GTM questions in PM interviews, share a practical framework you can use, and walk through real examples that will help you nail your next interview.

Understanding GTM Fundamentals and Questions

Before diving into frameworks, let’s level-set on what a go-to-market strategy actually is.

A GTM strategy is your comprehensive plan for bringing a product to market and achieving commercial success. It answers fundamental questions:

Who are we selling to? (Target market and customer segments)

What value are we delivering? (Positioning and messaging)

How much does it cost? (Pricing and packaging)

Where will customers find us? (Distribution channels)

How will we reach them? (Marketing and sales approach)

When do we know we’ve succeeded? (Success metrics)

As a PM, you might not own all these decisions, but you need to understand how they interconnect.

A brilliant product with the wrong pricing or positioned to the wrong audience will fail. GTM is where product strategy meets commercial reality.

Common GTM Interview Questions

Here are the questions you’re most likely to encounter:

“How would you launch this product?” (The most common and open-ended)

“Who is the target customer and why?”

“What channels would you use to acquire customers?”

“How would you position this product against competitors?”

“What would your launch timeline look like?”

“How would you measure launch success?”

“What would your messaging be for this product?”

Sometimes these come as standalone questions, other times they’re embedded in broader product strategy cases. Either way, having a systematic approach is essential.

How to Answer GTM Questions?

Use the C-T-P-D-M Framework:

Position & Price - How do you want to position and price the product?

This framework gives you a systematic approach to tackle any GTM question in interviews.

Let’s break down each step with detailed guidance on what to consider and how to articulate your thinking.

Step 1: Clarify Context

Never jump straight into your answer. Start by understanding the landscape you’re operating in. This demonstrates thoughtful problem-solving and prevents you from making incorrect assumptions.

What to ask and why:

1) Business Goal & Constraints

What’s the primary objective? (Revenue target, user acquisition, market share, brand awareness?)

What’s the timeline? (Aggressive 3-month launch vs. measured 12-month rollout changes everything)

What’s the budget? (Unlimited resources vs. lean startup constraints)

Any other constraints? (Team size, existing commitments, regulatory requirements)

Why this matters: A $10M budget with 6 months allows for different strategies than $100K with 2 months. Understanding constraints helps you propose realistic, executable plans.

2) Product Context

Is this a new product, new feature, or product update?

What stage are we at? (MVP, growth phase, mature product?)

What’s the product’s core functionality and key benefits?

Are there any technical limitations or dependencies?

Why this matters: GTM for an MVP (focus on learning and iteration) differs dramatically from a mature product update (focus on existing customer communication and retention).

3) Market Landscape

Are we entering a new market or competing in an existing one?

Who are the main competitors? What’s their positioning?

What’s the market size and growth rate?

Are there any recent market shifts or trends we should leverage?

Why this matters: In a crowded market, differentiation becomes critical. In a new market, education and category creation matter more.

4) Customer Baseline

Do we have existing customers we can leverage?

Do we have user data, research, or insights already?

Have we done any beta testing or early validation?

What do we know about customer behavior and preferences?

Why this matters: Existing customers provide built-in distribution, testimonials, and iteration opportunities. Starting from zero requires different acquisition strategies.

Example of good clarification: “Before I outline the GTM strategy, let me clarify a few things:

Is this a completely new product or an addition to our existing suite?

What’s our launch timeline and budget?

Are we targeting our current customer base or a new segment?

And what does success look like - are we optimizing for revenue, user growth, or market positioning?”

Step 2: Target (Who & Why)

Define your ideal customer with precision. Vague targeting leads to scattered efforts and poor results. Be specific about who you’re going after and why they’re the right choice.

1) Customer Segments: Build Your ICP

For B2B products, define by:

Firmographics: Company size (employees, revenue), industry vertical, geography, funding stage

Buyer personas: Job titles, roles, decision-making authority

Technographics: Current tech stack, tools they use

Behavioral: Buying patterns, decision-making process, budget cycles

For B2C products, define by:

Demographics: Age, income, location, education, occupation

Psychographics: Values, interests, lifestyle, attitudes

Behavioral: Purchase behavior, usage patterns, channel preferences

Pain points: Specific problems they’re trying to solve

Example B2C ICP: “Millennial parents (ages 28-40) in urban metros, household income $75K+, health-conscious, digitally native, time-starved, and actively looking for convenient solutions to maintain healthy eating habits for their families.”

Example B2B ICP: “Mid-market SaaS companies with 100-500 employees, $10M-$50M ARR, specifically targeting VP of Engineering or CTOs in North America. These companies are typically Series B-C funded, already using tools like GitHub and Jira, and have annual budget planning cycles in Q4.”

2) Unmet Needs: Understand the Pain

Go beyond surface-level problems. Understand:

Severity: How acute is the pain? Is it a “nice to have” or “must have”?

Frequency: How often do they experience this problem?

Current solutions: What are they doing today? Why is it inadequate?

Willingness to change: Are they actively seeking solutions or unaware of the problem?

Use this format: “[Target customer] struggles with [specific problem] which costs them [quantifiable impact]. Currently, they’re using [alternative] but it fails because [key limitation].”Example: “Engineering managers at mid-market companies struggle with code review bottlenecks that slow down deployment by 2-3 days per sprint. Currently, they rely on manual peer reviews, but 40% of bugs still slip through because reviewers are overworked and miss subtle issues.”

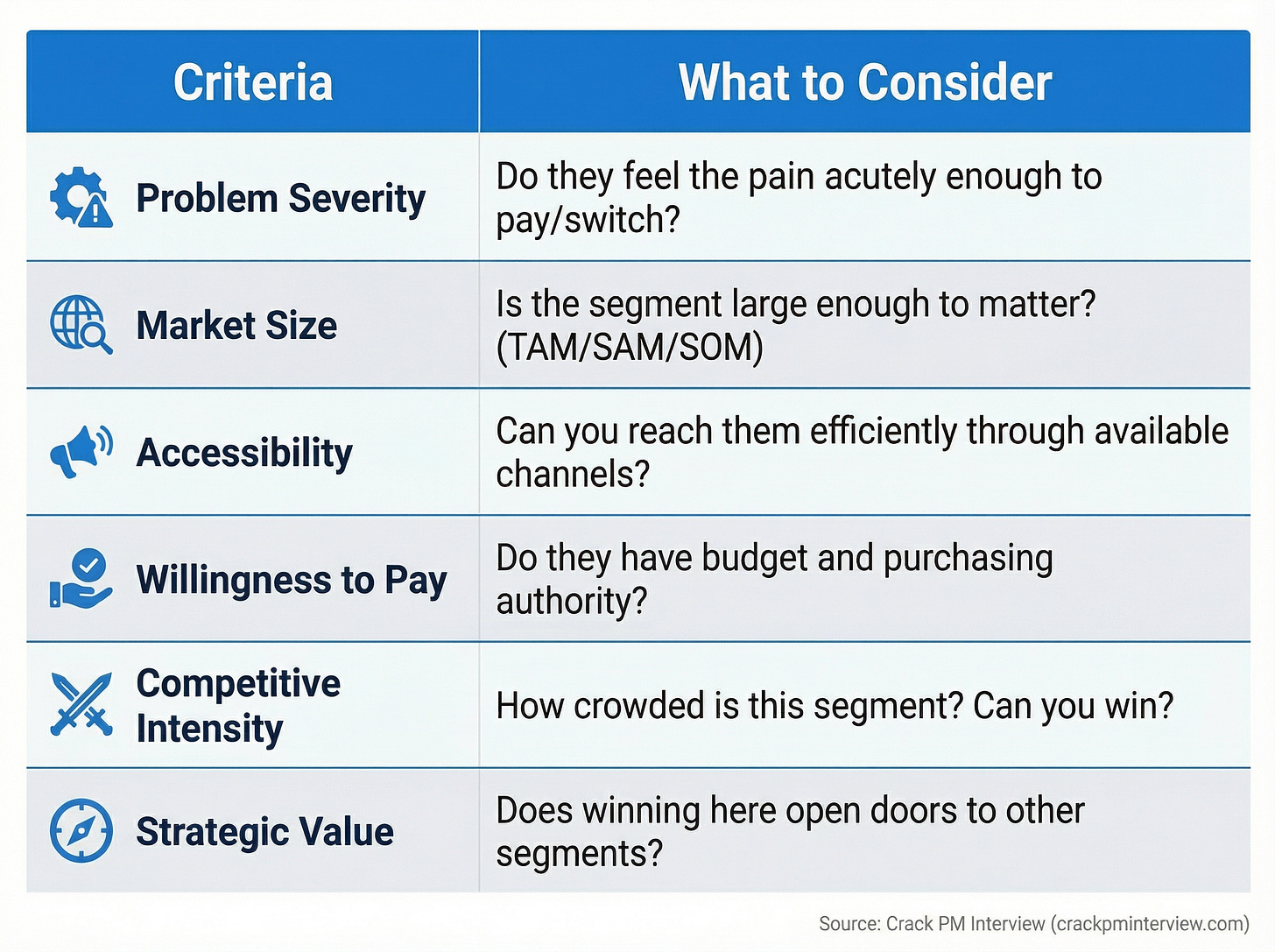

3) Segment Prioritization: Choose Your Beachhead

If multiple segments exist, explain which to target first using these criteria:

Keep reading with a 7-day free trial

Subscribe to Crack PM Interview to keep reading this post and get 7 days of free access to the full post archives.