Improve the Average Order Value for Meesho by 5%: A Complete PM Interview Answer

See how to tackle a metric-driven product improvement question with real business constraints

Picture this: You’re interviewing for a PM role at a leading Indian e-commerce company.

The interviewer leans forward and asks:

“Meesho’s average order value is around ₹400, which is significantly lower than competitors like Amazon and Flipkart at ₹1,000+. How would you improve the average order value at Meesho by 5%?”

Your first instinct might be to suggest premium features, subscription models, or minimum order requirements.

But here’s the catch:

Meesho’s low AOV is the result of the entire business model.

This is the kind of question that separates good PM candidates from exceptional ones. It tests whether you understand that sometimes, constraints ARE the strategy.

Today, I’ll walk you through exactly how to answer this question using the PQ-GUP-SEMS framework discussed in detail in my first post on “how to answer product improvement questions?”

Let’s dive in.

How To Answer Product Improvement Questions?

Here’s a proven nine-step framework for answering any product improvement question.

0. Keywords - Pay attention to the keywords in the question.

1. P - Product: Describe what the product does and who it serves.

2. Q – Questions: Ask clarifying questions to narrow the scope.

3. G – Goal: Define the business or user goal you’re improving.

4. U – Users: Identify user segments and pick one to focus on.

5. P – Pain Points: List key pain points for that segment.

6. S – Solutions: Brainstorm possible improvements.

7. E – Evaluate: Prioritize solutions and discuss trade-offs.

8. M – Metrics: Define success metrics.

9. S – Summarize: Recap your reasoning clearly.

Use the mnemonic PQ-GUP-SEMS to remember the sequence.

Step 0: Listen for Keywords

The question is: “Improve the Average Order Value at Meesho by 5%”

Let me break down what’s actually being asked:

“Improve the Average Order Value” - We’re focused on a specific metric, not general platform improvement

“By 5%” - This is a concrete, measurable target. For Meesho’s ₹350-500 AOV range, that’s an increase of ₹17.50-25 per order

“Meesho” - India’s fastest-growing value-focused e-commerce platform serving Tier 2/3+ cities

Note what’s NOT mentioned - No timeframe, no user segment specification, no geographic constraints

I’d write this question down exactly to ensure I stay focused throughout my answer.

The specificity of “5%” suggests this is a strategic initiative with clear measurement expectations.

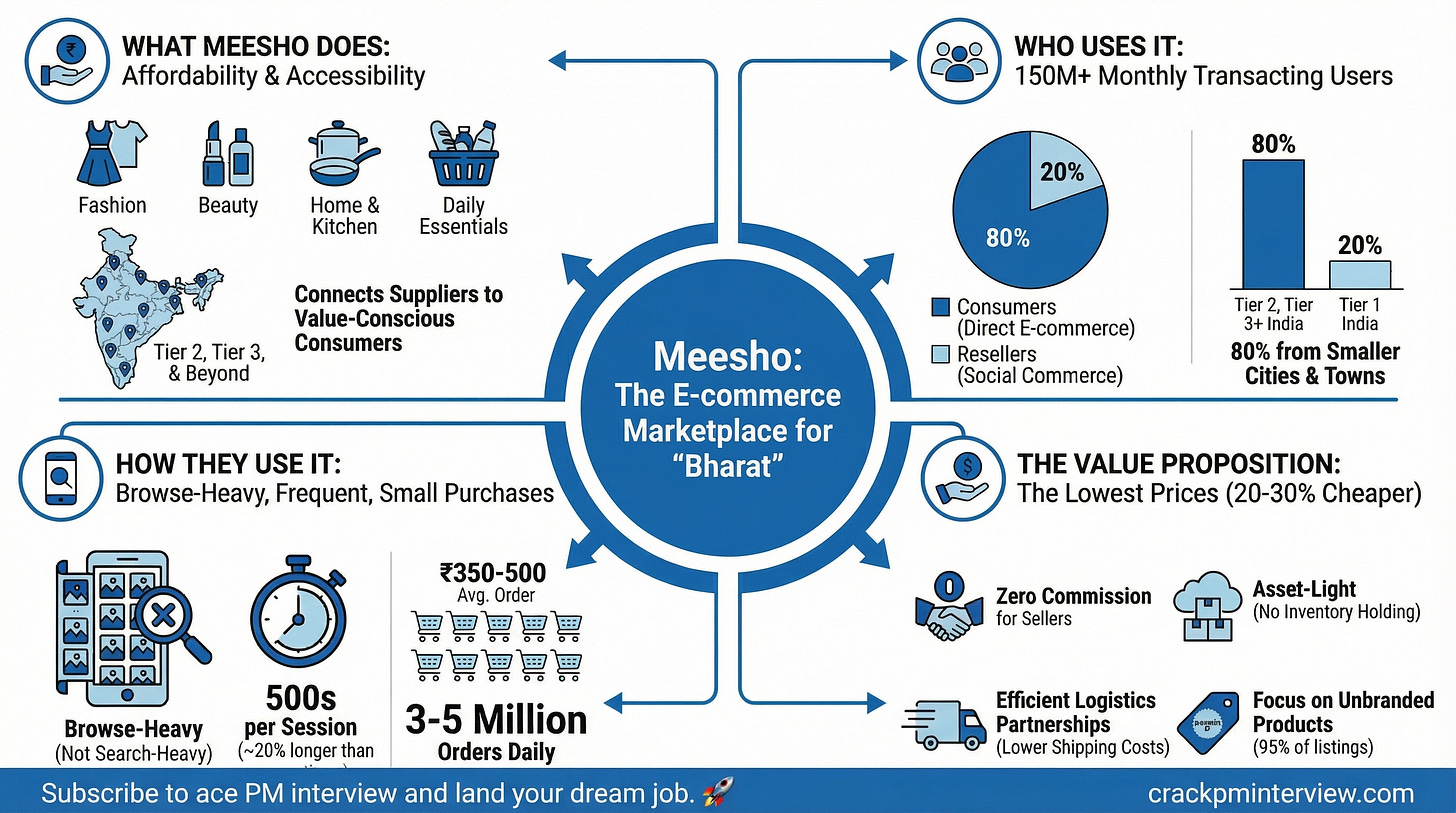

Step 1: Describe the Product

Before jumping to solutions, let me demonstrate I understand what Meesho actually is and why it matters.

What Meesho Does

Meesho is an e-commerce marketplace platform that connects suppliers with value-conscious consumers across India.

It operates primarily in fashion, beauty, home and kitchen, and daily essentials. What makes Meesho unique is its laser focus on affordability and accessibility for India’s Tier 2, Tier 3, and beyond markets.

Who Uses It

Meesho serves over 150 million monthly transacting users, with roughly 80% coming from smaller cities and towns across India.

The platform initially started as a social commerce reseller platform but has pivoted to direct e-commerce, with 80% of business now coming from direct consumers and 20% from resellers.

How They Use It

Users engage with Meesho in a distinctly different way than they do with Amazon or Flipkart. They’re browse-heavy rather than search-heavy, spending an average of 500 seconds per session - about 20% longer than on competing platforms.

They make small, frequent purchases rather than large, occasional ones. The platform handles 3-5 million orders daily, but each order averages just ₹350-500.

The Value Proposition

Meesho’s core promise is simple: the lowest prices.

Products on Meesho are typically 20-30% cheaper than on competitor platforms. The platform maintains this advantage through:

Zero commission model for sellers

Asset-light marketplace approach (no inventory holding)

Efficient logistics partnerships that reduce shipping costs

Focus on unbranded products (95% of listings)

The platform recently achieved profitability - a remarkable feat in Indian e-commerce, precisely, because it embraced rather than fought against low AOV economics.

Confirm with interviewer: “Does this align with your understanding of Meesho’s business model?”

Step 2: Ask Clarifying Questions

Before proceeding, I need to narrow the scope of this broad question.

Q1: Baseline and Target Clarification

“When you mention improving AOV by 5%, what’s our baseline? Is it ₹350, ₹400, or ₹500? This matters because 5% of ₹350 is ₹17.50 while 5% of ₹500 is ₹25 - a significant difference in strategy.”

Q2: Strategic Constraints

“Given that Meesho’s low AOV is fundamental to its value positioning, should I maintain the core promise of ‘lowest prices’? Or are we open to slightly shifting the value proposition?”

Q3: User Segment Focus

“Should I focus on existing users and behavior change, or are we open to attracting a different demographic that naturally has higher AOV? Also, should I focus on direct consumers, resellers, or both?”

Q4: Time Horizon

“What’s the timeframe for achieving this 5% improvement? Is this a quarterly OKR or an annual strategic goal?”

Q5: Geographic and Platform Scope

“Should this be a pan-India initiative, or would you like me to focus on specific regions? Any particular platform - app versus web?”

Assumed Interviewer Response:

“Good questions.

Let’s use ₹400 as the baseline, so we’re targeting ₹420. Focus on increasing AOV among existing direct consumers without compromising the value proposition that made Meesho successful. You have a 6-month timeframe. Pan-India approach, but you can prioritize segments as you see fit.”

Perfect. Now, we have clear parameters to focus on.

Step 3: Define the Goal

Primary Goal

Increase Average Order Value by 5%, that is, from ₹400 to ₹420, within 6 months among Meesho’s direct consumer base while maintaining the platform’s core value positioning.

Why This Matters Strategically

Bottom-Line Impact: A 5% AOV increase across 3-5 million daily orders translates to massive GMV growth. Over 6 months, that’s approximately ₹1,080-1,800 crores in additional gross merchandise value.

Unit Economics: Higher AOV improves contribution margins because fixed costs (customer acquisition, technology infrastructure, customer support) get spread across larger transactions. If shipping costs remain relatively fixed, a ₹420 order is significantly more profitable than a ₹400 order.

Logistics Efficiency: Larger orders mean better order consolidation. Instead of shipping a single ₹200 kurti, shipping a ₹420 order with a kurti plus accessories reduces per-item logistics costs, strengthening Meesho’s competitive advantage.

Seller Value: Higher AOV increases seller revenue per transaction, making the platform more attractive for suppliers and reducing seller churn.

Competitive Positioning: Growing revenue while maintaining price advantage creates a sustainable moat. We’re not trying to become Amazon; we’re becoming a better version of Meesho.

Success Definition

I’ll measure success through AOV reaching ₹420 and sustaining that level for at least 4 consecutive weeks, ensuring the improvement is behaviour change, not a temporary spike.

Step 4: Identify User Segments for Meesho

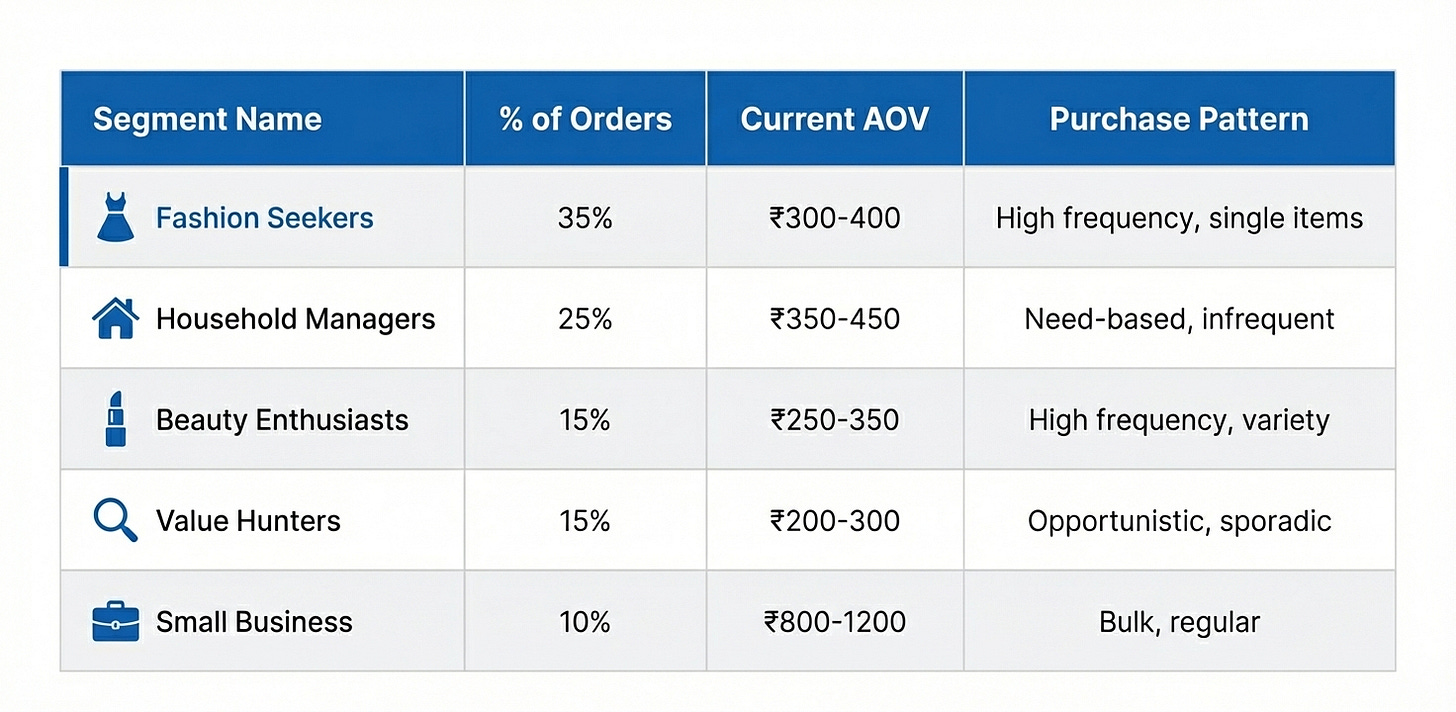

Meesho serves several distinct user segments with different needs and behaviours:

1) Fashion Seekers (35% of orders)

Profile: Primarily women aged 25-40 from Tier 2/3 cities who are fashion-conscious but budget-constrained.

Behaviour: They browse frequently, follow trends through social media and peer groups, and make regular fashion purchases. However, they typically buy single items rather than complete outfits.

Current AOV: ₹300-400 (typical purchases: one kurti, one saree, a pair of earrings)

Purchase Pattern: High frequency, single-item transactions, strong product research before buying

2) Household Managers (25% of orders)

Profile: Mixed demographics, typically primary household shoppers responsible for home supplies, kitchen items, and daily essentials.

Behaviour: Need-based shopping with specific requirements. They’re comparing prices across platforms and buying when they find the best deal.

Current AOV: ₹350-450

Purchase Pattern: Infrequent, need-fulfillment driven, less browsing

3) Beauty & Personal Care Enthusiasts (15% of orders)

Profile: Younger demographic (18-35), experimental with products, influenced by social media trends and recommendations.

Behaviour: Regular purchasers of beauty, skincare, and personal care products. They try new products frequently but in small quantities.

Current AOV: ₹250-350 (smaller product sizes, trial purchases)

Purchase Pattern: High frequency, variety-seeking, influenced by reviews

4) Value Hunters (15% of orders)

Profile: Extremely price-sensitive customers who comparison shop extensively.

Behaviour: They browse multiple platforms, track price drops, and buy only when they find exceptional deals. Less loyal, more transactional.

Current AOV: ₹200-300

Purchase Pattern: Opportunistic, sporadic, high cart abandonment

5) Small Business Buyers (10% of orders)

Profile: Small retailers, boutique owners, and remaining resellers who buy inventory for their own businesses.

Behaviour: Bulk purchases, business-focused decision-making, relationship-oriented.

Current AOV: ₹800-1200 (already significantly higher)

Purchase Pattern: Regular, larger baskets, established relationships with sellers

Segment Selection: Fashion Seekers

I’m choosing to focus on Fashion Seekers for the following strategic reasons:

Scale: At 35% of orders, they’re the largest segment. Impact here drives overall metrics significantly.

Growth Potential: Their current AOV of ₹300-400 has clear headroom. They’re already engaged users who understand the value proposition.

Natural Fit: Fashion naturally lends itself to cross-selling and outfit completion. A kurti buyer might genuinely benefit from matching accessories - this isn’t forced upselling but a value addition for the user.

Behaviour Patterns: They already browse extensively (500 seconds sessions), indicating willingness to discover products. They’re not transactional value hunters.

Network Effects: This demographic influences friends and family through social sharing, amplifying impact beyond individual transactions.

Value Alignment: Solutions for this segment can enhance user experience while maintaining Meesho’s affordability promise.

Step 5: List and Prioritize Pain Points

Let’s think through the specific friction points this segment faces.

1) Pain Point 1: No Styling Guidance or Outfit Completion

Description: Users buy individual fashion items without discovering complementary products that complete their look. A user purchases a beautiful kurti but doesn’t see the matching dupatta, earrings, or footwear that would create a complete outfit.

Impact on AOV: High. Every fashion transaction is a missed cross-sell opportunity.

Evidence: Users make single-item purchases despite browsing extensively, suggesting discovery issues rather than intent limitations.

2) Pain Point 2: Shipping Threshold Creates Purchase Friction

Description: While Meesho offers competitive shipping, users face a psychological barrier. They want free shipping but don’t know what to add to reach the threshold without feeling they’re buying unnecessary items.

Impact on AOV: High. Users either pay shipping (reducing perceived value) or abandon carts entirely.

Evidence: Cart abandonment data likely shows shipping cost as a primary abandonment reason for sub-threshold orders.

3) Pain Point 3: No Incentive for Multi-Item Purchases

Description: The platform doesn’t actively reward or encourage buying multiple items together. There are no bundles, no multi-buy discounts, no “complete the set” benefits.

Impact on AOV: High. Users have no economic motivation to add items beyond their immediate need.

Evidence: Low items-per-order ratio compared to potential basket sizes.

4) Pain Point 4: Limited Discovery Beyond Search

Description: Users who come with specific intent (searching for “red kurti”) don’t naturally discover related or complementary products unless they actively search again.

Impact on AOV: Medium-High. The browse-heavy behavior shows willingness to discover, but current product recommendation isn’t optimized.

Evidence: High session duration but low conversion rate from browsing to additional cart additions.

5) Pain Point 5: Generic Product Recommendations

Description: “You may also like” recommendations don’t account for what’s already in the cart or the shopping context (occasion, season, style preferences).

Impact on AOV: Medium. Poor recommendation relevance means users ignore suggestions.

Evidence: Low click-through rates on existing recommendation widgets.

6) Pain Point 6: Cart Abandonment Psychology

Description: Small-value carts feel less “worth it” psychologically. Users second-guess purchasing a single ₹200 item more than they would a ₹400 multi-item order.

Impact on AOV: Medium. Recovery of these carts could increase AOV if we solve what to add.

Evidence: Higher abandonment rates for below-average AOV carts.

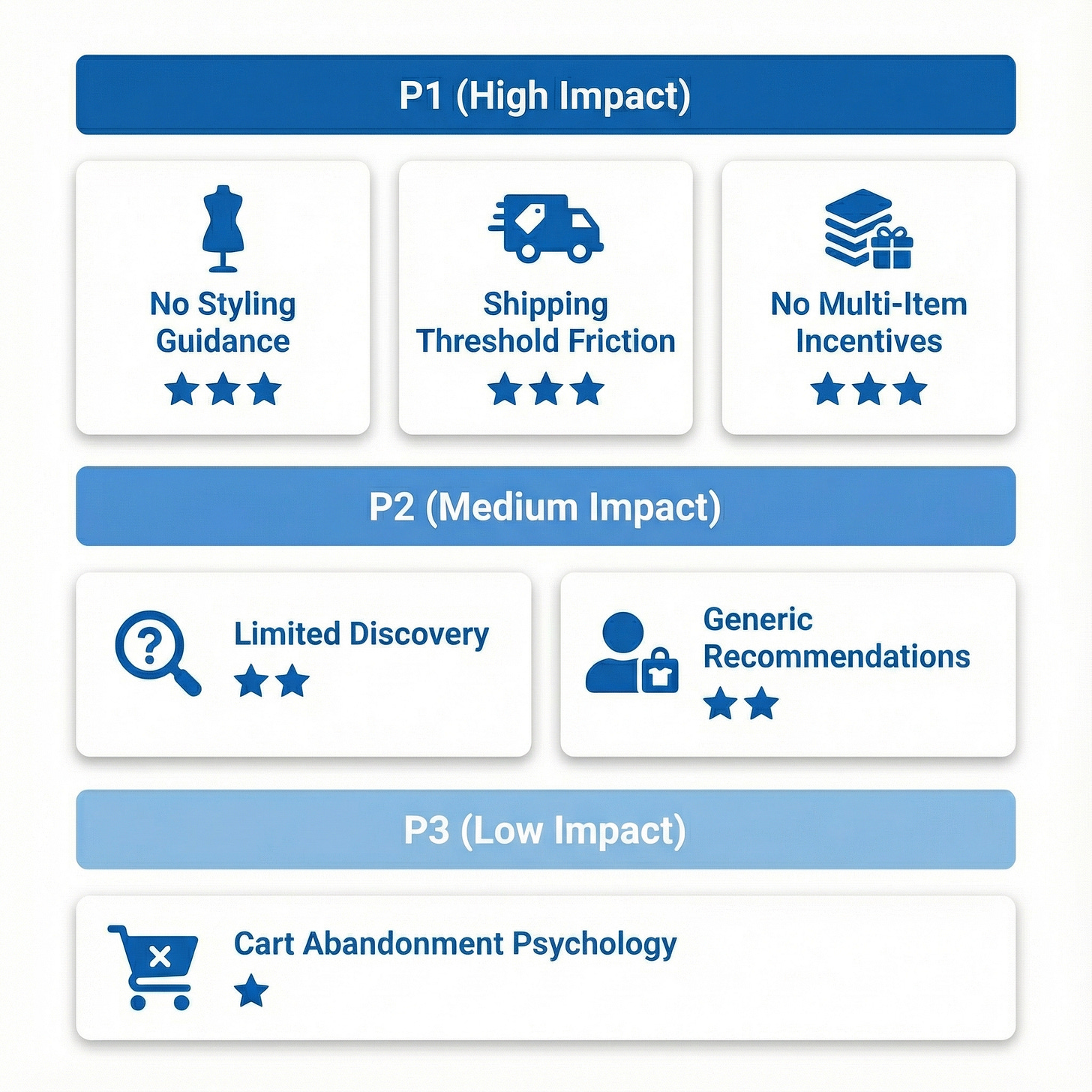

Prioritization

Based on impact × frequency × solvability, here’s my priority order:

P1 (Address Immediately):

No Styling Guidance or Outfit Completion - Highest impact, solves genuine user need, aligns with fashion shopping behavior

Shipping Threshold Creates Friction - Direct economic motivator, proven psychology, relatively easy to implement

No Incentive for Multi-Item Purchases - Quick wins possible with promotional mechanics

P2 (Near-term):

Limited Discovery Beyond Search

Generic Product Recommendations

P3 (Long-term):

Cart Abandonment Psychology

I’ll focus solutions on the P1 pain points, which together can drive the full 5% AOV increase.

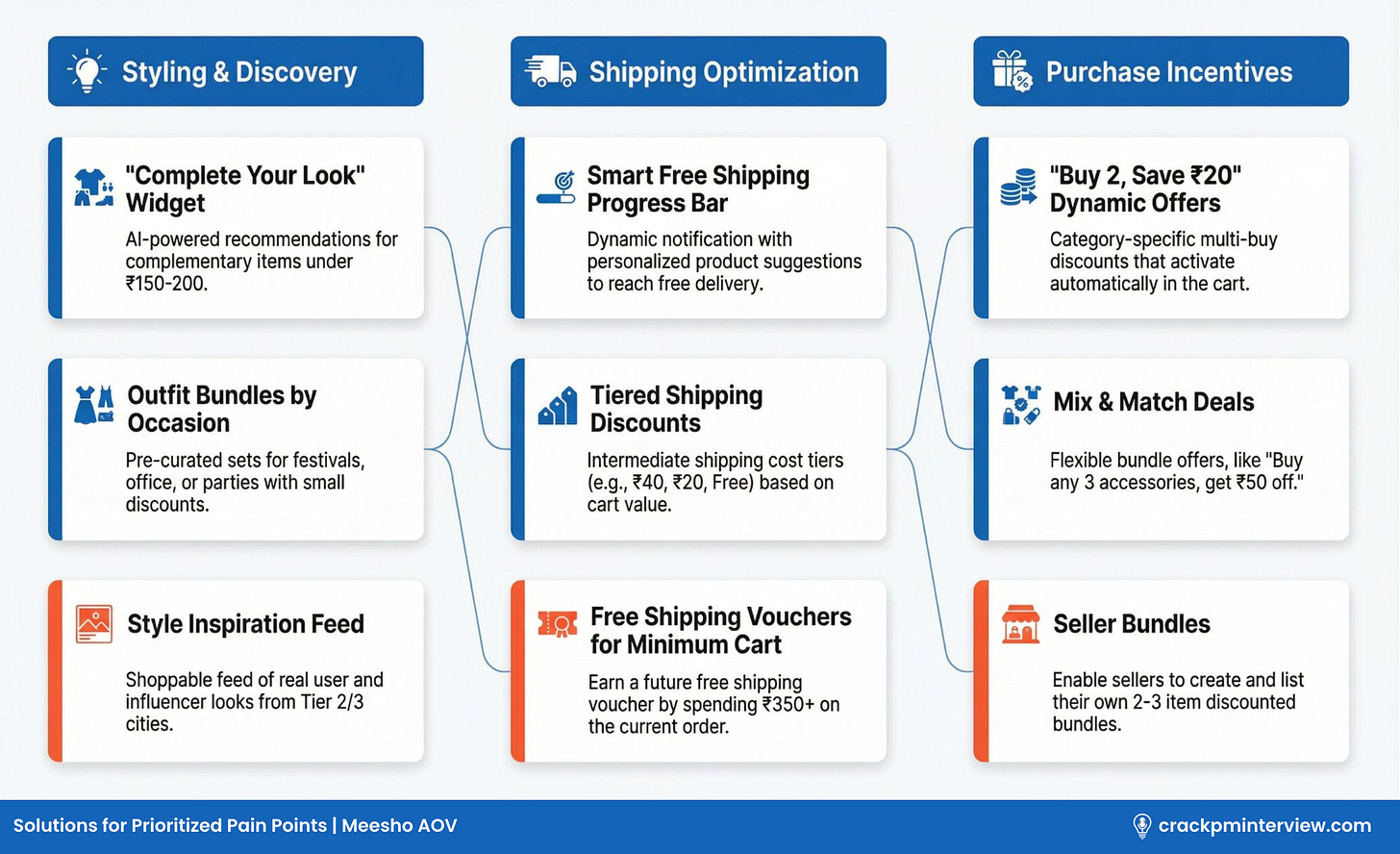

Step 6: List Out Solutions for Prioritized Pain Points

Now let’s brainstorm solutions for each prioritized pain point.

1) Solutions for Pain Point 1: No Styling Guidance

Solution 1A: “Complete Your Look” Widget

Create an AI-powered recommendation widget that appears when users view or add fashion items to their cart. When someone adds a kurti, the widget shows 3-4 complementary items: “Complete Your Look: Dupatta (₹120), Earrings (₹80), Sandals (₹180).”

The key is keeping the total additional spend under ₹150-200 to maintain affordability. Show the complete outfit visualization if possible, emphasizing how items work together.

Solution 1B: Outfit Bundles by Occasion

Create pre-curated outfit sets for common occasions: Festival Collection, Office Wear, Casual Weekend, Party Sets. Each bundle offers a small discount (₹20-30 off on ₹400+ bundles) and solves the decision fatigue of coordination.

For example: “Diwali Ready” bundle with kurti + dupatta + earrings + bindi set for ₹450 (₹30 savings vs. individual prices).

Solution 1C: Style Inspiration Feed

Develop an Instagram-style inspiration feed showing styled looks from real Meesho users or micro-influencers from Tier 2/3 cities. Every item in the photo is tagged with price and shoppable. Users can add individual items or entire looks.

This leverages Meesho’s existing strength in social commerce DNA while driving multi-item purchases through aspiration.

2) Solutions for Pain Point 2: Shipping Threshold Friction

Solution 2A: Smart Free Shipping Progress Bar

Implement a dynamic cart notification: “Add ₹X more for free delivery” with personalized product suggestions specifically selected to reach that threshold.

Unlike generic recommendations, these suggestions should be:

Within the remaining amount needed

Related to cart contents (accessories if they bought clothing)

Popular items in the user’s city/region

Genuinely useful additions, not filler

Solution 2B: Tiered Shipping Discounts

Instead of a binary free/paid shipping model, create tiers:

₹0-200: ₹40 shipping

₹200-300: ₹20 shipping

₹300+: Free shipping

This creates intermediate milestones that feel more achievable and reduces the psychological barrier of the full free shipping threshold.

Solution 2C: Free Shipping Vouchers for Minimum Cart

When users spend ₹350+, give them a free shipping voucher for their next order (valid on ₹250+ orders). This incentivizes higher AOV on the current order AND trains users to meet thresholds on future purchases.

3) Solutions for Pain Point 3: No Multi-Item Purchase Incentives

Solution 3A: “Buy 2, Save ₹20” Dynamic Offers

Implement category-specific multi-buy offers that activate automatically in the cart. When someone adds a fashion item, show: “Buy 2 items, Save ₹20. Buy 3 items, Save ₹40.”

The discount amount is calibrated to be less than shipping costs saved, maintaining healthy margins while feeling generous to customers.

Solution 3B: Mix & Match Deals

Create flexible bundle offers: “Buy any 3 items from Accessories Collection, get ₹50 off.” This works particularly well for smaller items like earrings, bangles, hair accessories where users might want variety.

Solution 3C: Seller Bundles

Enable sellers to create their own 2-3 item bundles at discounted rates. A saree seller can bundle saree + blouse + petticoat. These appear as distinct listings on product pages, giving sellers control while driving higher AOV.

Additional High-Impact Solutions

Solution 4: Enhanced Product Page Cross-Sells

Transform the “You may also like” section into “Others bought together,” showing actual purchase patterns. If data shows that 40% of users who bought this kurti also bought a specific dupatta, highlight that relationship.

Solution 5: “Trending in Your City” Section

Create a dedicated discovery section showing what’s popular in the user’s specific city or similar Tier 2/3 markets. This leverages geographic and cultural relevance while driving discovery beyond search.

Solution 6: Post-Add-to-Cart Recommendations

After a user adds an item to cart, show a targeted full-screen or modal interstitial: “Complete your purchase” with 3-4 highly relevant suggestions. The timing is critical - catch them while shopping intent is hot.

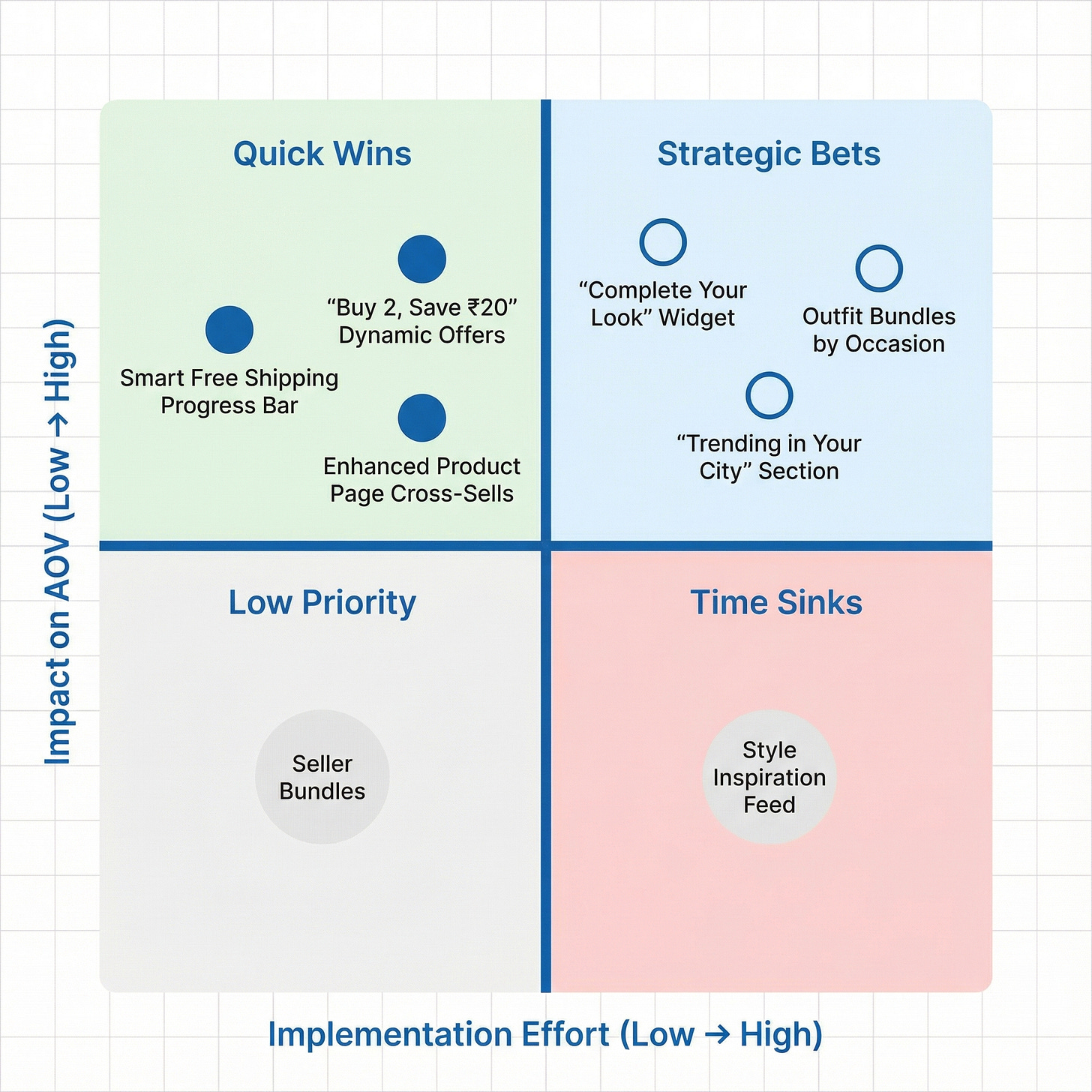

Step 7: Evaluate and Prioritize Solutions

Let’s assess these solutions across multiple dimensions:

Evaluation Criteria

AOV Impact: Direct effect on increasing order value

User Experience: Feels helpful vs. pushy or manipulative

Implementation Effort: Engineering complexity and timeline

Cost: Development plus ongoing operational costs

Value Preservation: Maintains “lowest price” positioning

Adoption Potential: Users will actually engage with this feature

Strategic Fit: Aligns with Meesho’s marketplace model and capabilities

Impact-Effort Analysis

High Impact, Low-Medium Effort (Build First):

Smart Free Shipping Progress Bar - Leverages existing cart infrastructure, adds intelligent suggestion layer. Proven psychology of goal completion. Low risk, high reward.

“Buy 2, Save ₹20” Dynamic Offers - Straightforward promotional mechanics, can be implemented through existing discount engine. Clear value proposition for users.

Enhanced Product Page Cross-Sells - Uses existing purchase data, improves current recommendation engine. Incremental improvement with clear ROI.

High Impact, Medium-High Effort (Phase 2 Priority):

“Complete Your Look” Widget - Requires ML/recommendation engine enhancement but solves core need. Worth the investment for long-term impact.

Outfit Bundles by Occasion - Requires curation effort (can start small with 50-100 bundles). High user value if executed well.

“Trending in Your City” Section - Uses existing data, needs geographic clustering logic and UI development. Strong relevance potential.

Medium Impact, High Effort:

Style Inspiration Feed - High effort (content creation infrastructure), uncertain adoption

Medium Impact, Low Effort:

Seller Bundles - Requires seller education and tools, slower rollout

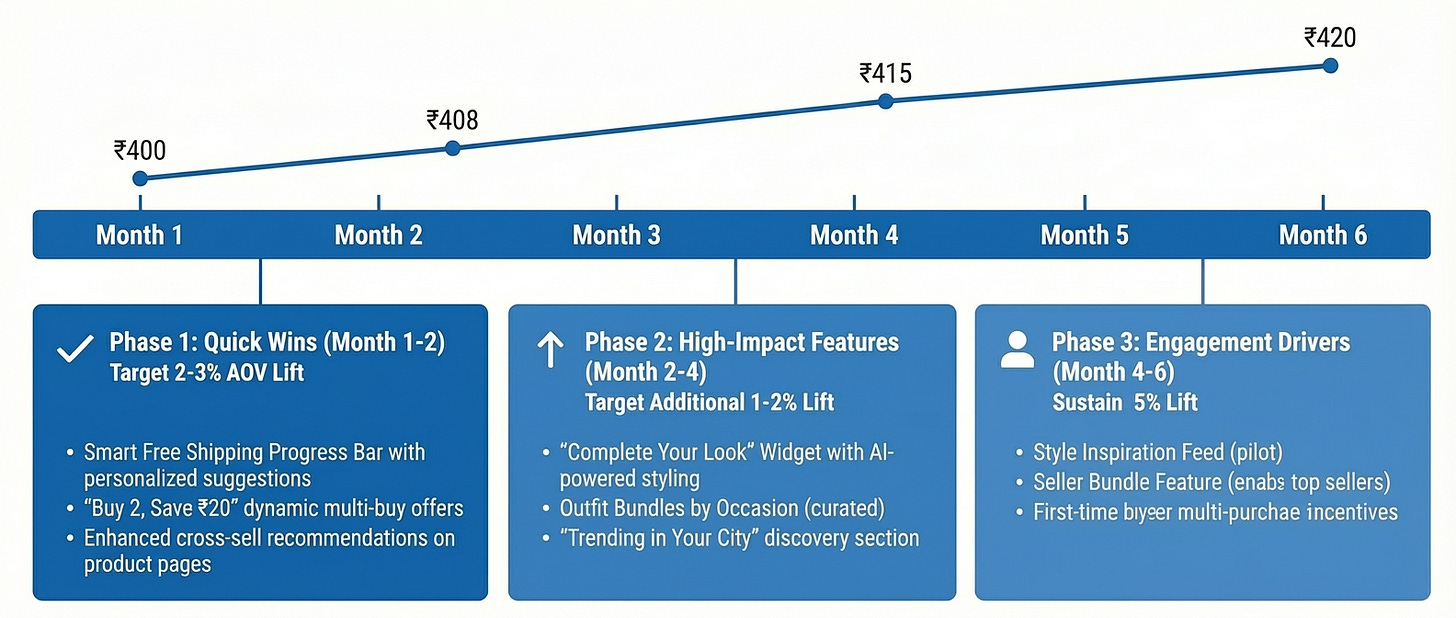

Recommended Phased Approach

Phase 1: Quick Wins (Month 1-2) - Target 2-3% AOV Lift

Smart Free Shipping Progress Bar with personalized suggestions

“Buy 2, Save ₹20” dynamic multi-buy offers

Enhanced cross-sell recommendations on product pages

These three features can be built and tested within 6-8 weeks. Together, they address immediate friction points and create multiple paths to higher AOV.

Phase 2: High-Impact Features (Month 2-4) - Target Additional 1-2% Lift

“Complete Your Look” Widget with AI-powered styling

Outfit Bundles by Occasion (curated 50-100 bundles initially, expand based on performance)

“Trending in Your City” discovery section

These require more development but deliver sustained engagement and repeat behavior.

Phase 3: Engagement Drivers (Month 4-6) - Sustain 5% Lift

Style Inspiration Feed (pilot with 100 micro-influencers from target cities)

Seller Bundle Feature (enable top 1000 sellers, monitor uptake)

First-time buyer multi-purchase incentives to train behaviour early

This phase focuses on making higher AOV the default behaviour rather than a one-time spike.

Trade-Offs Discussion

“Complete Your Look” Widget

Pros: Natural shopping behavior, improves discovery, genuinely helpful, high conversion potential

Cons: Recommendation accuracy is critical—poor suggestions harm trust more than help sales. Requires ongoing ML model refinement.

Mitigation: Start with simple rule-based logic (kurti → dupatta/earrings), evolve to machine learning as data improves. Allow users to dismiss/hide suggestions.

“Buy 2, Save ₹20” Offers

Pros: Simple mechanics, proven effective across e-commerce, creates urgency, clear value

Cons: Reduces per-item margin, may train users to wait for deals, could feel pushy if overdone

Mitigation: Ensure discount amount is less than shipping cost saved (maintaining margin). Make offers feel exclusive rather than constant. Time-bound where appropriate.

Outfit Bundles

Pros: Reduces decision fatigue, convenient, clear value proposition, taps into occasion-based shopping

Cons: Curation effort required, risk of poor-matching items, potential inventory complications if pre-packaged

Mitigation: Use dynamic bundles (items selected at purchase time, not pre-packaged). Enable seller participation to reduce platform curation burden. Start with high-confidence occasions (festivals, weddings).

Shipping Threshold Strategies

Pros: Directly motivates cart building, well-understood user behavior, economics make sense

Cons: Users may perceive as manipulation, might add low-value items just to hit threshold, could increase returns

Mitigation: Suggest genuinely relevant items, not just cheapest options. Monitor return rates by item type to catch “filler” additions. Make suggestions feel helpful, not forced.

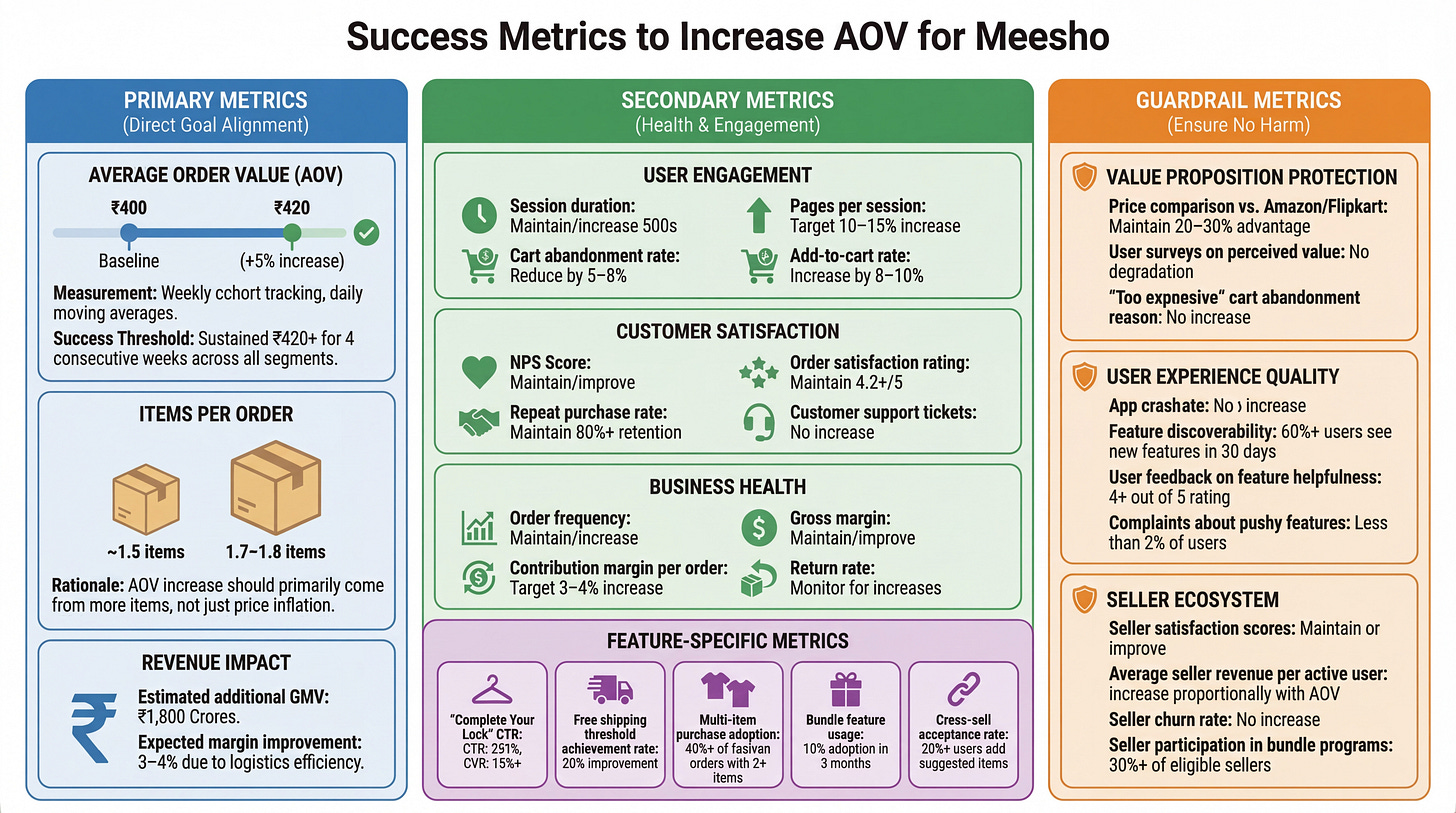

Step 8: Define Success Metrics to Increase AOV for Meesho

Primary Metrics (Direct Goal Alignment)

Average Order Value

Baseline: ₹400

Target: ₹420 (5% increase)

Measurement: Weekly cohort tracking, daily moving averages

Success Threshold: Sustained ₹420+ for 4 consecutive weeks across all segments

Items Per Order

Baseline: ~1.5 items per order (estimated)

Target: 1.7-1.8 items per order

Rationale: AOV increase should primarily come from more items, not just price inflation

Revenue Impact

5% AOV increase across 3-5M daily orders over 180 days

Estimated additional GMV: ₹1,080-1,800 crores

Expected margin improvement: 3-4% due to logistics efficiency

Secondary Metrics (Health & Engagement)

User Engagement

Session duration: Maintain or increase current 500 seconds

Pages per session: Target 10-15% increase (more discovery)

Cart abandonment rate: Reduce by 5-8%

Add-to-cart rate: Increase by 8-10%

Customer Satisfaction

NPS Score: Maintain or improve current levels

Order satisfaction rating: Maintain 4.2+ out of 5

Repeat purchase rate: Maintain 80%+ retention

Customer support tickets: No increase from feature confusion

Business Health

Order frequency: Maintain or increase (ensure AOV doesn’t cannibalize frequency)

Gross margin: Maintain or improve (watch discount impact)

Contribution margin per order: Target 3-4% increase through logistics efficiency

Return rate: Monitor for increases from impulse additions

Feature-Specific Metrics

“Complete Your Look” click-through rate: 25%+, conversion rate: 15%+

Free shipping threshold achievement rate: 20% improvement vs. baseline

Multi-item purchase adoption: 40%+ of fashion orders with 2+ items

Bundle feature usage: 10% of applicable orders use bundles within 3 months

Cross-sell acceptance rate: 20%+ of users add suggested items

Guardrail Metrics (Ensure No Harm)

Value Proposition Protection

Price comparison vs. Amazon/Flipkart: Maintain 20-30% advantage

User surveys on perceived value: No degradation

“Too expensive” cart abandonment reason: No increase

User Experience Quality

App crash rate: No increase

Feature discoverability: 60%+ users see new features within 30 days

User feedback on feature helpfulness: 4+ out of 5 rating

Complaints about pushy features: Less than 2% of users

Seller Ecosystem

Seller satisfaction scores: Maintain or improve

Average seller revenue per active user: Increase proportionally with AOV

Seller churn rate: No increase

Seller participation in bundle programs: 30%+ of eligible sellers

Measurement Methodology

A/B Testing Framework

Control group: Current experience (20% of users)

Test groups: Individual features tested separately, then combined (80% of users)

Minimum 2-week test periods per feature

Statistical significance threshold: 95% confidence

Cohort Analysis

New users vs. returning users tracked separately

Segment by: Geography, category preference, historical AOV, user tenure

Monitor for cannibalization (increased AOV in one category reducing another)

Qualitative Feedback

In-app surveys: Monthly NPS plus feature-specific feedback

User interviews: 20-30 depth interviews per month across test groups

Seller surveys: Quarterly feedback on platform changes

Support ticket analysis: Weekly review of feature-related inquiries

Success Milestones

Month 2:

2% AOV increase achieved (₹400 → ₹408)

35% of target users engage with Phase 1 features

Positive sentiment on feature helpfulness (4+ rating)

No negative impact on retention or satisfaction

Month 4:

4% AOV increase achieved (₹400 → ₹416)

50% of users regularly engage with features

Features becoming habitual (30%+ repeat usage rate)

Contribution margin improvement visible

Month 6:

5%+ AOV increase sustained (₹420+)

Feature adoption plateaus at healthy level

Behavior change evident in cohort data

Business case validated for continued investment

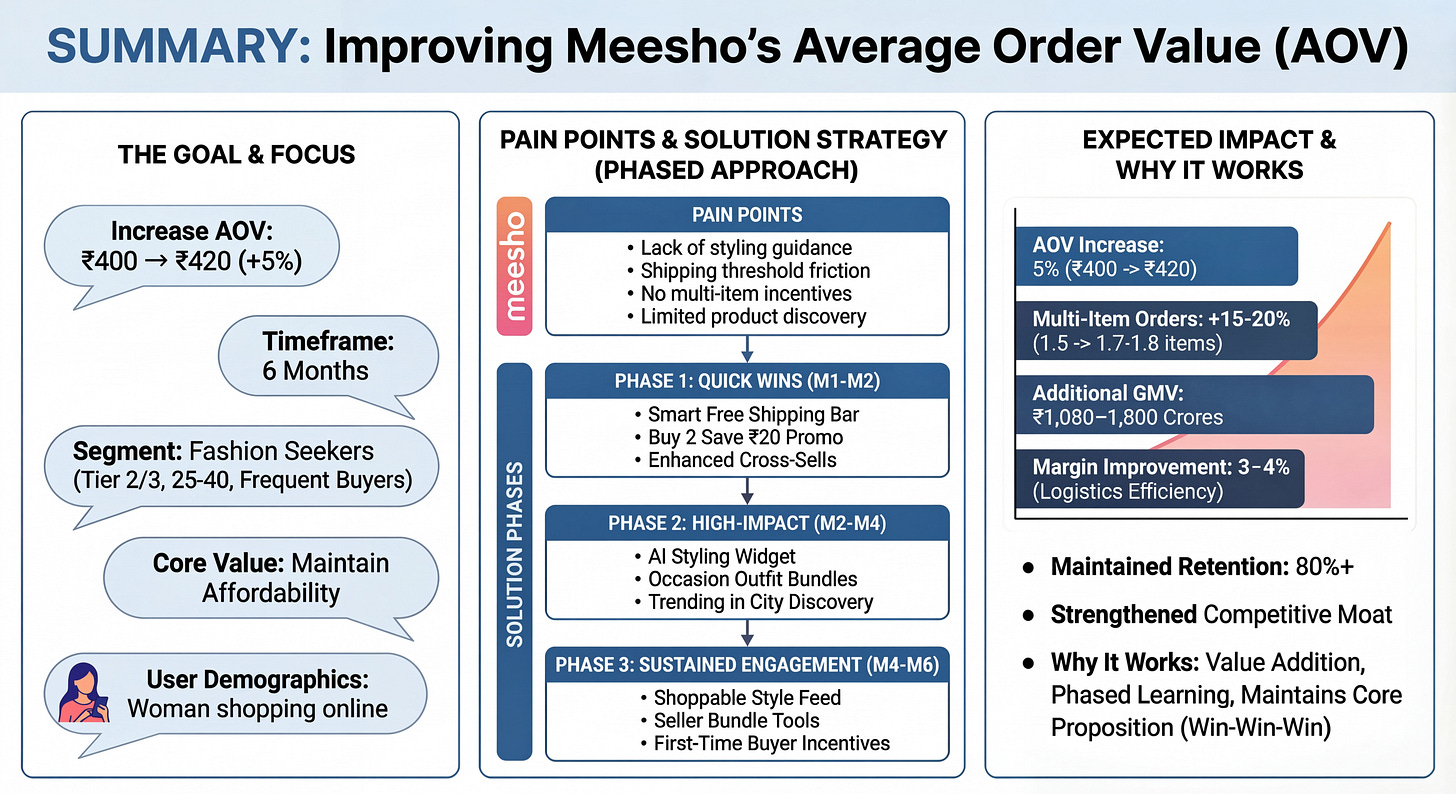

Step 9: Summary

Let’s bring this all together.

The Question: Improve the Average Order Value at Meesho by 5%

The Goal: Increase AOV from ₹400 to ₹420 among Fashion Seekers within 6 months while maintaining Meesho’s core value positioning as India’s most affordable e-commerce platform.

The User Segment: Fashion Seekers - women aged 25-40 from Tier 2/3 cities who make frequent single-item fashion purchases, representing 35% of Meesho’s order volume. They’re already engaged users with medium AOV and clear growth potential through outfit completion.

The Key Pain Points We Identified for Fashion Seekers on Meesho:

Lack of styling guidance and outfit completion suggestions

Shipping threshold creates friction without clear path to free delivery

No incentives or rewards for multi-item purchases

Our Prioritized Solutions - to be released in phased manner:

Phase 1 (Months 1-2): Quick Wins

Smart free shipping progress bar with personalized add-on suggestions

“Buy 2, Save ₹20” dynamic multi-buy promotional offers

Enhanced “Others bought together” cross-sell recommendations

Phase 2 (Months 2-4): High-Impact Features

“Complete Your Look” AI-powered styling widget

Curated outfit bundles for occasions (festivals, parties, office)

“Trending in Your City” geographic discovery section

Phase 3 (Months 4-6): Sustained Engagement

Style inspiration feed with shoppable looks

Seller bundle creation tools for top sellers

First-time buyer incentives to establish multi-item behavior early

Expected Impact:

5% AOV increase: ₹400 → ₹420 per order

15-20% increase in multi-item orders (1.5 → 1.7-1.8 items/order)

₹1,080-1,800 crores additional GMV over 6 months

3-4% contribution margin improvement through logistics efficiency

Maintained 80%+ customer retention rate

Strengthened competitive moat through better unit economics

Why This Approach Works:

This strategy increases AOV through genuine value addition rather than manipulation. We’re helping users discover and purchase items they actually want- completing outfits, finding complementary products, getting better deals on multi-item purchases.

The phased approach allows us to learn and iterate, starting with proven quick wins before investing in more complex features. We’re not asking Meesho to become Amazon; we’re making Meesho better at being Meesho.

Most importantly, we maintain the core value proposition that made Meesho successful. Users still get the lowest prices, sellers still benefit from zero commissions, and the platform becomes more sustainable through improved economics - a true win-win-win scenario.

Key Takeaways for Your Interview

If you faced this question in an interview, here’s what would make your answer stand out:

✅ Strategic Nuance: Understanding that Meesho’s low AOV is intentional positioning, not a problem to “fix.” The goal is thoughtful growth, not transformation.

✅ User Empathy: Deeply understanding the Tier 2/3 audience and what drives their behavior. Solutions that work for metro users may backfire here.

✅ Practical Prioritization: Using a phased approach with quick wins before big bets. Showing you understand resource constraints and risk management.

✅ Metrics Rigor: Defining comprehensive success metrics including guardrails. Demonstrating you think about unintended consequences.

✅ Business Acumen: Connecting AOV improvement to unit economics, seller value, and competitive positioning. Showing you understand the business, not just the product.

Practice Exercise: More Product Improvement Questions

The Meesho question is fascinating because it tests whether you understand constraint-based innovation. Low AOV isn’t the enemy - it’s what enables Meesho to serve a massive underserved market profitably.

Similar questions to practice:

Increase Swiggy’s average order value by 10%

Improve Zomato’s AOV without hurting order frequency

Grow Myntra’s basket size for fashion shoppers

Use the PQ-GUP-SEMS framework for each one. Time yourself - aim to complete your answer in 30-40 minutes, just like in a real interview.

The more you practice, the more natural this structured thinking becomes.

Found this helpful? Subscribe to Crack PM Interview for more interview frameworks, real question breakdowns, and insider tips from FAANG PMs.

The insight about Meesho's low AOV being intentional positioning rather than a problem to fix is crucial and often missed. Candidates tend to jump to solutions that would fundamentally break the value prop. I especially like the phased approach starting with the free shipping progress bar since it's both low-effort and addresses real user psychology. One thing I'd add: watch for the unintended consequence where users add items just to hit thresholds then return them, which could actually hurt contribution margins. The guardrail metrics around return rates by item type would catch this early.